Preparing year-end accounts needs proper planning and organisation, yet many business owners find themselves rushing at the last minute, risking penalties and unnecessary stress.

The difference between a smooth year-end process and a chaotic one often comes down to having a clear plan and starting early enough to sort out issues as they come up. When you break the work into weekly tasks, the process becomes manageable and you can meet all HMRC deadlines without difficulty.

Whether you’re a sole trader preparing your first Self-Assessment return or a limited company director managing statutory accounts, this structured approach helps you stay organised and compliant.

This guide gives you a practical timeline you can follow, with specific tasks for each week leading up to your deadline.

Key Takeaways

- Start 10 weeks before your deadline to allow enough time for gathering documents, checking everything and fixing problems

- Sole traders must file Self-Assessment returns by 31 January, while limited companies face separate deadlines for Companies House (9 months) and HMRC (12 months)

- Weekly organisation stops last-minute rushes and reduces errors that could trigger penalties or HMRC enquiries

- Professional support is available if needed and the cost is usually less than penalties for late or incorrect filing

- Regular record-keeping throughout the year makes year-end preparation much simpler and more accurate

Understanding Your Deadlines

The first step is knowing when your accounts are due. The dates depend on your business structure. Missing these deadlines results in automatic penalties from HMRC, so you must be clear about your obligations from the start.

Sole Trader Deadlines

Sole traders must file a Self-Assessment tax return. For the tax year ending 5 April 2025:

| Task | Deadline |

|---|---|

| Register for Self-Assessment (new businesses) | 5 October 2025 |

| File paper tax return | 31 October 2025 |

| File online tax return | 31 January 2026 |

| Pay tax owed | 31 January 2026 |

Note that on 31 January, you pay your tax bill for the previous year and make your first payment on account for the current year.

Limited Company Deadlines

Limited companies report to both Companies House and HMRC. Your deadlines are based on your company’s financial year end date:

| Task | Deadline |

|---|---|

| File accounts with Companies House | 9 months after year end |

| Pay Corporation Tax | 9 months + 1 day after year end |

| File Company Tax Return (CT600) | 12 months after year end |

For example, a company with a year-end of 31 March 2025 must file accounts by 31 December 2025 and pay Corporation Tax by 1 January 2026.

How to Approach Your Year-End Preparation?

Different businesses require different preparation times. The complexity of your accounts, the quality of your record-keeping and the resources available to you all affect how long the process takes.

Some businesses maintain organised records throughout the year and complete their accounts quickly. Others need more time to gather documentation and verify information.

This timeline recommends starting 10 weeks before your deadline. This allows sufficient time to complete all necessary tasks without rushing.

You can adjust this timeframe based on your circumstances. Well-organised businesses might need less time, while those with complex affairs should consider starting earlier.

Week-by-Week Timeline

Each week addresses specific tasks. This structured approach ensures you complete everything systematically and reduces the risk of errors or omissions.

Week 10: Initial Organisation

Mark all relevant deadlines in your calendar. Decide whether you will handle accounts preparation internally or engage accounting services. Many businesses use outsourcing for accountants during busy periods. This is a practical decision that allows you to focus on running your business.

Confirm you have the necessary tools and access. This includes accounting software, filing systems and access to all business bank accounts and financial records.

Week 9: Document Collection

Gather all financial documents from the year:

- Complete bank statements for all business accounts

- Sales invoices issued to customers

- Purchase invoices and receipts from suppliers

- Credit card statements used for business expenses

- Payroll records if you employ staff

- Documentation for asset purchases

Organise these documents in a logical system. Whether digital or physical, your filing method should allow quick retrieval of specific documents when needed.

Week 8: Bank Reconciliation

Verify that every transaction in your bank statements matches your accounting records. Review each month systematically. Confirm that all income and expenditure is recorded correctly and that your recorded balance matches your actual bank balance.

When you identify discrepancies, investigate the cause immediately. Common issues include duplicate entries, unrecorded bank charges, or missing transactions. Resolving these now prevents problems later in the process.

Week 7: Payroll Verification

If you employ staff, confirm that all statutory submissions to HMRC were made correctly during the year. Verify that Full Payment Submissions were filed each pay period and that all PAYE and National Insurance contributions were paid on time.

Prepare P60 forms for distribution to employees. The legal deadline for providing P60s 31 may following the tax year end.

Week 6: Expense Review

Document all business expenditure for the year. Common allowable expenses include:

- Premises costs (rent, rates, utilities)

- Equipment and supplies

- Business travel

- Professional fees (legal, accounting)

- Insurance premiums

- Marketing expenditure

- Staff costs

For limited companies, review capital allowances on qualifying assets. These year-end adjustments in accounting can reduce your taxable profit. Ensure all claimed expenses are genuinely business-related and properly documented. When uncertain, consult HMRC guidance or seek professional advice.

Week 5: VAT Reconciliation

VAT-registered businesses should verify that all returns for the year were submitted correctly and on time. Confirm that you claimed input VAT on all eligible business purchases. Unclaimed VAT represents funds you can recover from HMRC.

Review your VAT records thoroughly. Businesses sometimes overlook legitimate VAT claims, particularly on smaller purchases accumulated throughout the year.

Week 4: Asset Register Update

Review all business assets including equipment, vehicles and property. Update your records to reflect:

- New asset acquisitions during the year

- Disposals or write-offs

- Current asset values after depreciation

This information forms part of your year-end financial statements and is particularly important for limited company statutory accounts.

Week 3: Tax Calculation

Calculate your estimated tax liability. This allows you to prepare the necessary funds and avoid payment difficulties.

- Sole traders: Calculate your profit (total income minus allowable expenses). Apply income tax rates and National Insurance contributions to determine your liability.

- Limited companies: Calculate Corporation Tax on your company’s profit. Current rates are 19% on profits up to £50,000, increasing progressively to 25% on profits exceeding £250,000.

- Confirm you have sufficient funds available for payment. If you anticipate difficulties, contact HMRC before the deadline. They may agree to a payment plan if you approach them proactively.

Week 2: Accounts Finalisation

Complete your formal accounts and returns.

- Sole traders: Finalise your Self-Assessment tax return with all income and expenditure correctly recorded.

- Limited companies: Prepare full statutory accounts comprising profit and loss account, balance sheet and supporting notes explaining significant items.

Check all figures carefully. Common errors include incorrect totals, misplaced decimal points and figures entered in wrong categories. If you are using outsourced year-end accounts services, provide them with all necessary information this week to allow adequate preparation time.

Week 1: Submission and Payment

Submit your accounts and tax returns before the deadline. Avoid submitting on the final day when HMRC systems experience high traffic and potential technical issues.

Arrange payment to arrive before the deadline. Electronic payments typically require 3-5 working days to clear. Direct Debit mandates may need longer to establish. Retain copies of all submitted documents. UK law requires businesses to keep financial records for six years.

Common Errors in Accounts Preparation

Understanding frequent mistakes helps you avoid them. These errors cause delays, penalties and potential HMRC enquiries.

- Insufficient Preparation Time: Starting too late is the most common problem. Allow adequate time to locate documents, investigate discrepancies and verify all information.

- Inadequate Documentation: You cannot claim expenses without supporting evidence. Maintain all receipts throughout the year. For paper receipts, create digital copies as backup.

- Mixed Business and Personal Finances: Maintain separate bank accounts and credit cards for business use. This separation simplifies accounts preparation and demonstrates clear SME year-end compliance.

- Not Understanding Allowable Expenses: Some people claim expenses they should not claim while others forget legitimate business expenses. If you are uncertain about an expense, verify it against HMRC guidance or obtain HMRC compliance support from a qualified accountant.

- Lack of Tax Planning: Strategic planning can legally reduce your tax liability. For example, pension contributions made before year end reduce taxable profits. However, you must plan these decisions well in advance, not immediately before the deadline.

Professional Support Options

You are not required to prepare accounts entirely independently. Many businesses benefit from professional assistance, particularly during the year-end closing process.

Professional accounting services can assist with:

- Ongoing bookkeeping throughout the year

- Year-end accounts preparation

- Accurate tax return preparation

- Tax liability calculations

- Strategic tax planning advice

Outsourcing bookkeeping or engaging outsourced teams provides access to specialist knowledge and ensures compliance with current regulations. The cost of professional accounts preparation is typically less than penalties for errors or late filing. Additionally, it allows you to focus on operating your business rather than managing complex accounting requirements.

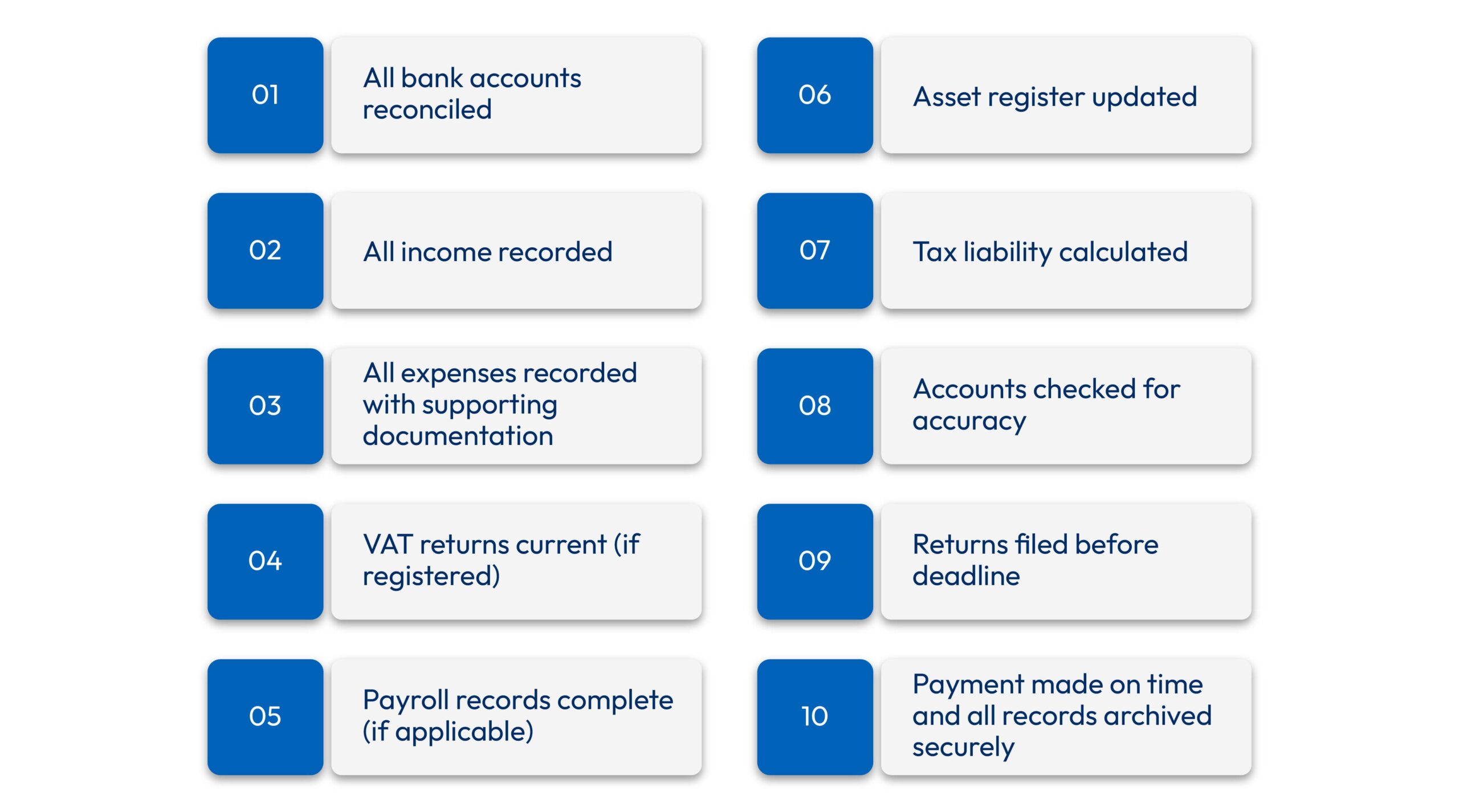

Accounts Preparation Checklist

Use this accounting checklist to verify completion of all tasks:

Best Practices for Year-End Compliance

Maintaining good practices throughout the year significantly simplifies year-end work. These methods help ensure smooth accounts preparation and reduce the risk of errors.

- Maintain Regular Records: Update your accounting records weekly rather than accumulating work until year end. Regular maintenance takes less total time and produces more accurate results.

- Implement Accounting Software: Modern accounting software connects directly to your bank accounts and imports transactions automatically. This reduces manual data entry and associated errors. Established options include Xero, QuickBooks and FreeAgent.

- Reserve Funds for Tax: Set aside approximately 25-30% of your profit each month for tax obligations. This ensures funds are available when payment is due and prevents cash flow problems.

- Keep Digital Records: Digital record-keeping is more efficient and secure than paper-based systems. HMRC’s Making Tax Digital requirements already mandate digital records for many businesses. Digital systems also facilitate easier retrieval and backup of important documents.

- Seek Clarification When Needed: If you are uncertain about any aspect of your accounts or tax obligations, seek clarification immediately. HMRC provides extensive guidance on GOV.UK and operates telephone support lines. Professional accountants can address questions before minor uncertainties develop into significant problems.

Conclusion

Year-end accounts require systematic preparation and attention to detail. Starting early and following a structured weekly plan makes the process manageable. Whether you prepare accounts internally or engage outsourcing partners, a clear plan is essential for meeting all year-end deadlines efficiently.

Your year-end financial statements serve purposes beyond HMRC compliance. They provide valuable insight into your business performance, showing income sources, expenditure patterns and overall profitability. This information helps you make better business decisions for the coming year.

Missing HMRC deadlines results in financial penalties, but accurate accounts offer benefits beyond avoiding penalties. They help you understand your business performance and identify areas requiring improvement, making them valuable management tools rather than merely regulatory requirements.

Frequently Asked Questions

When should I begin preparing year-end accounts?

Begin 8-10 weeks before your filing deadline. This provides sufficient time to gather documents, investigate discrepancies and verify all information.

What are the consequences of missing filing deadlines?

HMRC imposes automatic penalties. Self Assessment incurs a £100 penalty immediately, even if no tax is owed. Limited companies face penalties from Companies House starting at £150.

Can I submit accounts before the deadline?

Yes, you may file as soon as your accounting period ends. Early submission avoids last-minute technical issues and allows more time to arrange payment.

Is professional accounting assistance necessary?

This depends on your circumstances. Sole traders with straightforward accounts may manage independently, while limited companies typically benefit from professional assistance due to more complex requirements.

What legal methods exist to reduce tax liability?

Legal methods include claiming all allowable business expenses, making pension contributions, timing asset purchases to maximise capital allowances and verifying eligibility for available tax reliefs.

What records must businesses retain?

UK law requires retention of all business financial records for six years. This includes all invoices, receipts, bank statements, payroll documentation, VAT records and previous tax returns.

Parul is a content specialist with expertise in accounting and bookkeeping. Her writing covers a wide range of accounting topics such as payroll, financial reporting and more. Her content is well-researched and she has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.