Year-end accounting doesn’t have to be a nightmare. With proper planning and organisation, you can transform your year-end accounting preparation into a smooth, manageable process.

Many small businesses choose year-end accounts and corporation tax support to ensure compliance with HMRC and avoid last-minute errors.

However, following a structured year-end accounting checklist makes everything simpler. This guide will walk you through each step of the process.

This year-end accounting checklist is designed to help UK small businesses prepare accurate year-end accounts and avoid last-minute issues.

Why Year-end preparation matters?

Proper accounting year-end process planning saves time and money. It ensures accurate financial reporting and helps identify potential tax savings.

Year-end accounts preparation is not just a compliance task-it forms the basis of company accounts preparation for Companies House and HMRC.

Every company must prepare accounts that report on the performance and activities of the company during the financial year. Missing deadlines can result in penalties and complications.

Early preparation also reduces stress levels significantly. Starting months ahead gives you breathing room for unexpected issues.

Essential Year-end accounting checklist

Document organisation phase

Begin by gathering all financial documents systematically. Create folders for different document types to maintain order.

Key documents to collect:

- Bank statements for all accounts

- Credit card statements and loan documents

- All receipts and invoices (both sent and received)

- Payroll records and employment documentation

- Asset purchase records and depreciation schedules

- VAT returns and correspondence with HMRC

Store digital copies in cloud storage for easy access. This prevents last-minute scrambling for missing paperwork.

Monthly task breakdown

| Month | Key Tasks | Priority Level |

|---|---|---|

| October | Start document collection, review chart of accounts | High |

| November | Reconcile bank statements, chase outstanding invoices | Critical |

| December | Complete expense categorisation, prepare depreciation | Essential |

| January | Year-end financial close, file returns | Urgent |

Starting early prevents the common problem of catch-up bookkeeping at the last minute. This systematic approach ensures nothing gets missed.

Small business accounting Year-end essentials

Small business accounting year-end requirements differ from larger companies. Understanding these differences helps streamline your process.

Most small businesses can use simplified accounting methods. This reduces complexity and saves valuable time during busy periods.

Focus on accuracy rather than perfection initially. You can always make adjustments after the initial review is complete.

Critical steps for small businesses

Reconcile bank statements thoroughly before proceeding further. This forms the foundation of accurate year-end accounts.

Match every transaction to supporting documentation carefully. Unexplained items should be investigated immediately to avoid delays later.

Update your accounting software with all transactions. Modern accounting software year-end tools can automate many routine tasks effectively.

How to prepare for Year-end accounting if you’re behind?

This section is especially relevant if your bookkeeping is months or even years behind.

If you’re starting late, don’t panic. Many businesses find themselves in this situation, especially when daily operations take priority over bookkeeping.

When you’re behind, the goal is not perfection – it’s bringing your year-end accounts to a compliant and workable position without unnecessary stress.

What to do if you’re behind on bookkeeping before year-end:

Start by focusing on high-impact areas rather than trying to fix everything at once. Prioritise transactions that directly affect your tax position and statutory reporting.

Use bank statements as your primary source of truth. They provide a complete and reliable transaction history, making it easier to identify income, expenses, and missing entries.

Work backwards from the most recent financial period instead of older years. Completing the latest year first helps meet deadlines and reduces immediate compliance risks.

Identify gaps such as missing receipts or unexplained transactions early so they don’t delay the entire year-end process.

If the backlog feels unmanageable, consider professional bookkeeping support. Temporary or outsourced assistance can help you catch up faster while maintaining accuracy.

Last minute Year-end accounting checklist

Week 1:

- Reconcile bank statements for the last six months

- Organize financial documents by category and date

- Identify missing receipts or documentation gaps

Week 2:

- Finalize invoices and expenses for the current year

- Calculate depreciation on major assets purchased

- Review loan balances and interest calculations

Week 3:

- Complete trial balance and make necessary adjustments

- Prepare for tax season by gathering required forms

- Review accounting policies for consistency throughout the year

Week 4:

- Closing the books at year-end procedures

- Generate preliminary financial statements for review

- Schedule appointments with tax advisors if needed

Accounting software Year-end tools

Modern technology significantly simplifies year-end processes through automation. Modern tools streamline admin and improve accuracy when set up correctly.

Popular UK accounting software includes Xero, QuickBooks, and Sage. These platforms offer year-end reporting for accountants features that automate calculations.

Most software can generate year-end reports automatically once data entry is complete. This eliminates manual calculation errors and saves considerable time.

Software features comparison

| Software | Year-End Reports | Bank Reconciliation | Automated Backups |

|---|---|---|---|

| Xero | ✓ Comprehensive | ✓ Real-time | ✓ Daily |

| QuickBooks | ✓ Standard | ✓ Manual/Auto | ✓ Weekly |

| Sage | ✓ Professional | ✓ Advanced | ✓ Configurable |

| FreeAgent | ✓ Tax-focused | ✓ Integrated | ✓ Automatic |

Choose software that integrates with your bank feeds. This reduces manual data entry and improves accuracy significantly throughout the year.

Stress free Year-end closing process for accountants

Professional accountants can implement systematic approaches to reduce client stress levels. Clear communication and realistic timelines are essential components.

Year-end accounting tips for small businesses include setting client expectations early. Provide detailed timelines and required document lists in advance.

Create template checklists for different business types and sizes. This ensures consistent service delivery while reducing preparation time for each client.

Many businesses also choose year-end accounting services to reduce workload and ensure compliance during busy periods.

Client communication strategy

Send initial requests three months before year-end deadlines. This gives clients adequate time to gather required documentation without rushing.

Provide regular progress updates throughout the process to maintain transparency. Clients appreciate knowing where they stand at each stage.

Offer multiple communication channels including email, phone, and video calls. Different clients prefer different communication methods for optimal collaboration.

Year-end financial close best practices

The year-end financial close requires systematic attention to detail and timing. Rushing this process often leads to errors that require corrections later.

Complete all adjusting entries before generating final reports. This includes accruals, prepayments, and depreciation calculations for accurate results.

Review unusual transactions or account balances for explanations. Large or unexpected changes should be investigated and documented thoroughly.

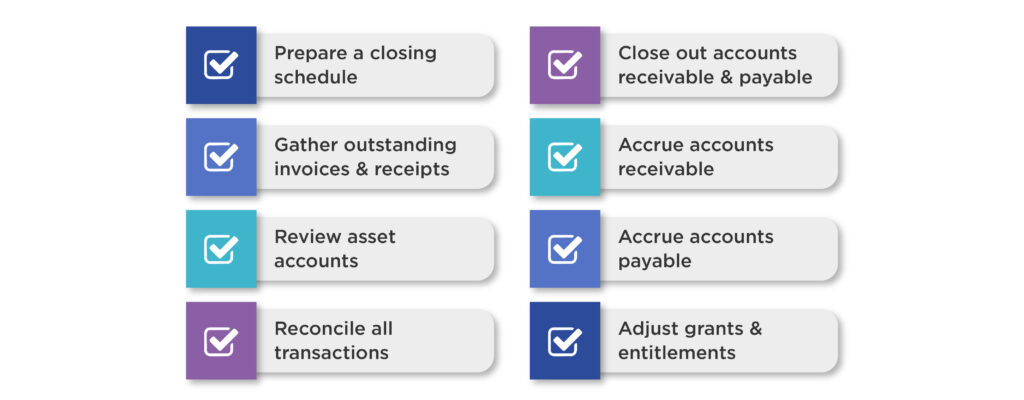

This checklist covers key year-end accounting steps such as preparing a closing schedule, gathering invoices, reviewing assets, reconciling transactions, closing receivables and payables, accruing income and expenses, and making final adjustments.

Final review checklist

- All bank accounts reconciled to the penny

- Asset registers updated with current year additions

- Tax-ready financials prepared according to regulations

- Supporting documentation filed and easily accessible

- Management accounts compared to prior year for reasonableness

Preparing for tax season success

Prepare for tax season by ensuring all documentation is complete and organised systematically. Missing information causes delays and potential penalties.

Gather all relevant tax forms including P60s, dividend vouchers, and expense receipts. Create separate files for different tax categories.

Review potential tax-saving opportunities before finalising accounts. Timing certain transactions can significantly impact your tax liability.

Tax documentation requirements

Personal Tax:

- P60 and P45 forms from employment

- Self-employment income and expense records

- Investment income statements and gains/losses

- Pension contribution certificates

Corporation Tax:

- Complete profit and loss accounts

- Balance sheet with detailed breakdowns

- Corporation tax computation worksheets

- Supporting schedules for major items

Common Year-end mistakes to avoid

Many businesses make predictable errors during year-end processing. Learning from these mistakes saves time and reduces complications significantly.

Top mistakes include:

Leaving everything until the last minute creates unnecessary pressure. Start planning at least three months before your year-end date.

Failing to reconcile bank statements regularly throughout the year compounds problems. Monthly reconciliation prevents major discrepancies from accumulating.

Not backing up data before making year-end adjustments risks losing work. Always create backup copies before significant changes.

Ignoring depreciation calculations can materially misstate asset values. Review depreciation policies annually and apply them consistently.

Year-end accounting tips for small businesses

Small businesses benefit from simplified approaches that balance accuracy with efficiency. Don’t overcomplicate processes unnecessarily.

Maintain consistent accounting policies throughout the year rather than changing them at year-end. Consistency improves comparability and reduces confusion.

Document unusual transactions or decisions made during the year. This helps explain variances during the review process.

Consider professional assistance for complex areas like tax planning. The cost often pays for itself through proper advice and compliance.

Monthly preparation tips

Throughout the year:

- Maintain organised filing systems for all documents

- Reconcile accounts monthly rather than leaving everything until year-end

- Track business mileage and expenses contemporaneously

- Review profit and loss statements for unusual items

Quarterly reviews:

- Compare actual results to budgets or prior periods

- Update cash flow forecasts based on current performance

- Review aged debtor reports and chase overdue amounts

- Assess tax liability estimates and make provisions accordingly

Technology solutions for efficiency

Modern accounting software year-end tools have revolutionised the closing process through automation and integration. Tools like Dext, AutoEntry, and Hubdoc automate receipt capture and data extraction with high accuracy when configured well.

Cloud-based solutions provide real-time access from anywhere with internet connectivity. This flexibility helps during busy year-end periods when working longer hours.

Automated bank feeds reduce manual data entry errors significantly. Most UK banks now support direct integration with major accounting platforms.

Receipt scanning apps capture expense information instantly using smartphone cameras. This eliminates the need to store physical receipts in most cases.

Integration benefits

Connected systems share data automatically between different functions like payroll and accounting. This reduces duplicate data entry and improves accuracy.

Real-time reporting provides immediate visibility into financial performance throughout the year. Early identification of issues allows for timely corrections.

Audit trails track all changes made to financial data automatically. This supports compliance requirements and simplifies external audits when required.

Managing cash flow during Year-end

Year-end often creates temporary cash flow pressures from professional fees and tax payments. Planning for these costs prevents financial stress.

Set aside funds monthly rather than facing large bills unexpectedly. A separate savings account helps accumulate money gradually throughout the year.

Consider payment plans for large tax liabilities where available. HMRC offers time-to-pay arrangements in certain circumstances.

Cash flow planning table

| Expense Category | Typical Cost | When Due | Planning Strategy |

|---|---|---|---|

| Professional fees | £1,000-£5,000 | January-March | Monthly savings |

| Corporation tax | Based on profits | 9 months after year-end | Quarterly provisions |

| Dividend tax | Personal rates | 31 January | Annual planning |

| Software subscriptions | £200-£2,000 | Various | Budget annually |

Conclusion

Successful year-end accounting preparation comes down to planning, organisation, and starting early enough to avoid last-minute stress.

Use this year-end accounting checklist as your roadmap through the process. Breaking tasks into manageable chunks makes everything more achievable.

Remember that the stress-free year-end closing process for accountants and business owners alike depends on consistent effort throughout the year rather than heroic efforts at the end.

Prepare for tax season success by maintaining good records and seeking professional advice when needed. The investment in proper preparation always pays dividends.

Your accounting year-end process doesn’t have to be painful. With the right approach and tools, it becomes just another manageable business task rather than an annual crisis.

Frequently Asked Questions

When should I start my year-end accounting preparation?

Begin at least three months before your year-end date.

What happens if I miss my filing deadline?

Late filing results in penalties from Companies House and HMRC.

Can I handle year-end accounts myself?

Simple businesses can manage it, but complex cases benefit from professional help.

What should I do if my bookkeeping is years behind before year-end?

Start with bank statements, prioritise the most recent financial year, and focus on transactions that impact tax and compliance. Professional support can help you catch up efficiently without errors.

Parul is a content specialist with expertise in accounting and bookkeeping. Her writing covers a wide range of accounting topics such as payroll, financial reporting and more. Her content is well-researched and she has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.