The UK Budget 2025, announced on 26 November 2025, introduces significant small business changes affecting small and medium enterprises (SMEs) across the country.

The autumn budget 2025 brings tax adjustments, compliance updates and workflow changes that impact every small business owner.

This comprehensive guide breaks down the budget impact on small businesses and explores how outsourced accounting can ease the transition.

Key Takeaways:

- Stable corporation tax rates aid planning certainty.

- Business rates relief saves retail, hospitality, leisure sectors.

- Dividend tax hikes need extraction strategy reviews.

- MTD expansion requires digital systems.

- Varied changes demand coordinated rollout.

- Outsourcing accounting grows cost-effective amid complexity.

- Early planning maximizes benefits, cuts disruption.

- Expert advice gains value with evolving rules.

Capital Allowances: Changes to Investment Relief

The Budget 2025 adjusts capital allowances affecting business investment decisions.

From April 2026, main rate writing-down allowances decrease from 18% to 14%.

However, a new 40% first-year allowance launches from 1 January 2026.

This applies to main rate assets, encouraging continued investment.

Unlike full expensing, unincorporated businesses and leasing assets qualify for this relief.

Impact on Small Businesses:

| Change | Timing | Effect |

|---|---|---|

| Writing-down allowance reduction | April 2026 | Slower tax relief on equipment |

| New 40% first-year allowance | January 2026 | Immediate investment incentive |

| Annual Investment Allowance | Unchanged | £1 million relief continues |

Small business accounting workflows must track these allowance changes carefully.

Business Rates Relief: Supporting the High Street

The Budget 2025 delivers permanent support for retail, hospitality and leisure sectors.

From April 2026, these businesses receive 75% business rates relief.

The standard multiplier drops from 55.5p to 48p in 2026-27.

The small business multiplier falls from 49.9p to 43.2p.

Over 750,000 properties benefit from these permanently lower rates, worth £900 million annually.

Additional Support:

Businesses expanding to a second property now receive extended grace periods.

Small Business Rates Relief protection extends from one year to three years.

This helps SMEs grow without immediate rate increases on new premises.

Making Tax Digital Expansion

Making Tax Digital (MTD) continues expanding its reach across small businesses.

From April 2026, HMRC changes affecting small businesses introduce broader enforcement powers for MTD compliance.

The “soft landing” period offers some relief for first-time filers.

Businesses joining MTD for Income Tax in April 2026 won’t face penalties on their first four quarterly updates.

Digital Prompts Incoming:

New digital prompts launch for VAT (2027) and Corporation Tax (2028).

These prompts flag incomplete or late returns within accounting software.

Small business accounting workflow changes require compatible digital systems to support MTD compliance for SMEs.

Dividend Tax Increases Hit Owner-Managers

The Autumn Budget 2025 proposes a 2-percentage point increase in dividend tax rates from April 2026.

The basic rate climbs to 10.75%, whilst the higher rate reaches 35.75%.

The £500 dividend allowance remains unchanged.

This significantly impacts small company directors relying on dividend income.

Planning Considerations:

Many owner-managers combine salary and dividends for tax efficiency.

The dividend tax increase makes salary extraction relatively more attractive.

Early small business tax planning for 2025 becomes essential before April 2026 implementation.

Outsourced accounting for small businesses can model optimal extraction strategies.

Income Tax and National Insurance Threshold Freezes

The Budget extends income tax threshold freezes until April 2031.

National Insurance thresholds for employees and self-employed also remain frozen.

This “fiscal drag” pulls more people into higher tax bands as wages rise.

The Secondary Threshold stays at current levels from April 2028 to April 2031.

Combined with wage inflation, this increases the effective tax burden on small businesses.

HMRC Compliance and Anti-Avoidance Measures

Tax compliance updates feature prominently in the UK Budget 2025.

HMRC invests heavily in closing the tax gap through enhanced enforcement.

New measures target tax avoidance promoters with stronger penalties.

A reward scheme launches for informants providing valuable evasion information.

Increased Penalties:

Fixed penalties for late corporation tax filing double from April 2026.

This restores penalty values to real-term equivalence after decades without increase.

Digital record-keeping becomes mandatory under expanded MTD rules.

SME Bookkeeping Requirements: What Changes?

The autumn budget 2025 introduces several bookkeeping workflow adjustments.

Digital record-keeping becomes increasingly mandatory across tax categories.

Software integration with HMRC systems requires compatible accounting platforms.

Data accuracy expectations rise with automated checking systems.

Key Workflow Changes:

- Electronic invoicing preparation for 2029 VAT compliance

- Quarterly digital submissions under expanded MTD

- Real-time tax calculations via integrated software

- Enhanced record retention for HMRC audits

- More frequent reporting cycles across multiple taxes

These small business accounting workflow changes demand significant administrative capacity.

How the 2025 UK Budget Accounting Implications Affect SME Workflows

Managing new tax workflows after Budget 2025 requires systematic approach.

Businesses must track multiple tax changes with different implementation dates.

Capital allowances, VAT rules, dividend rates and property income all shift independently.

Cash flow forecasting becomes more complex with staggered changes.

Timeline of Changes:

| Date | Change |

|---|---|

| January 2026 | New 40% first-year allowance begins |

| January 2026 | Private hire VAT scheme ends |

| April 2026 | Dividend tax rises, NLW increases |

| April 2026 | Business rates relief starts |

| April 2026 | MTD penalties become more flexible |

| April 2027 | Property income separate tax bands |

| April 2029 | E-invoicing mandatory for VAT |

| April 2029 | Pension salary sacrifice cap |

Coordinating these changes requires sophisticated accounting systems and expertise.

The Case for Outsourced Accounting for Small Businesses

Budget 2025 changes make outsourced bookkeeping for small businesses in the UK increasingly attractive

Professional accountants stay current with evolving tax compliance updates.

They manage software upgrades, system integration and HMRC communications.

This frees business owners to focus on core operations.

Cost-Benefit Analysis:

| In-House | Outsourced |

|---|---|

| Software licences | Included in service |

| Training costs | Provider expertise |

| Staff time | Redirected to growth |

| Error risk | Professional liability cover |

| System updates | Automatic implementation |

Outsourcing bookkeeping often costs less than part-time staff whilst delivering superior expertise.

How Outsourcing Helps with 2025 Budget Changes

Professional accounting services excel at navigating complex regulatory transitions.

They implement HMRC changes 2025 small businesses face without disruption.

Updated tax planning strategies maximise reliefs and minimise liabilities.

Regular reporting keeps business owners informed of financial position.

Specific Support Areas:

- Tax Planning: Optimal salary-dividend mix post-dividend tax increase

- Capital Allowances: Maximising new 40% first-year allowance claims

- MTD Compliance: Seamless quarterly digital submission management

- E-Invoicing Preparation: Early system implementation before 2029 deadline

- Cash Flow Forecasting: Impact modelling of all Budget changes

How outsourcing helps with 2025 budget changes becomes clear when considering cumulative complexity.

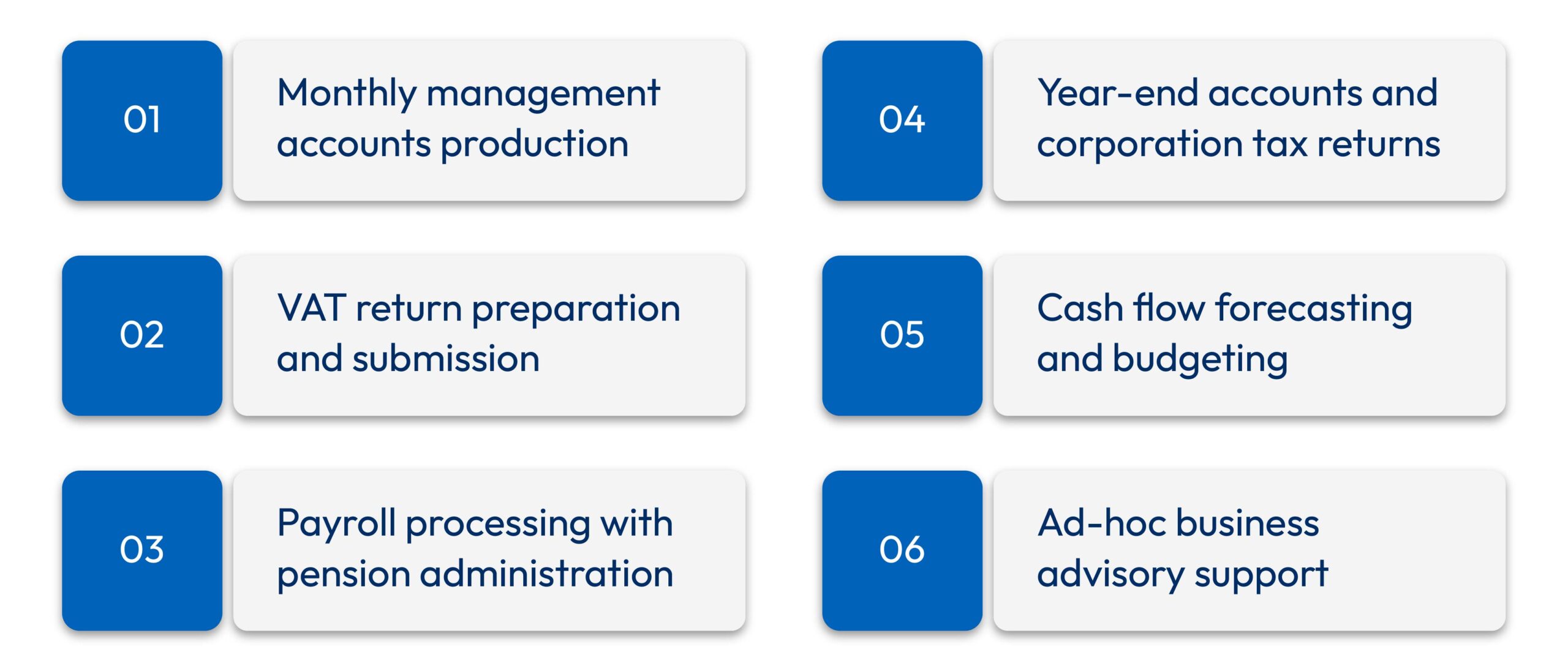

Outsourced Accounting: Core Services

Professional outsourced accounting encompasses comprehensive financial management.

Services extend beyond basic bookkeeping to strategic business support.

Regular management accounts provide decision-making insights.

Tax compliance updates happen automatically without business owner intervention.

Standard Service Package:

Outsourcing bookkeeping creates predictable monthly costs without surprise bills.

Choosing the Right Accounting Partner

Selecting appropriate outsourced accounting for small businesses requires careful evaluation.

Look for providers with proven SME sector experience.

Technology capabilities should match business complexity and growth plans.

Responsive communication and proactive advice separate excellent from adequate services.

Selection Criteria:

- Qualifications: Chartered or certified accountant status

- Technology: Modern cloud accounting platform expertise

- Sector Knowledge: Understanding of industry-specific challenges

- Service Scope: Comprehensive offerings beyond basic compliance

- Communication: Accessible team with dedicated account management

- Pricing: Transparent fixed monthly fees without hidden charges

Small business accounting success depends heavily on partnership quality.

Managing Cash Flow After Budget Changes

The UK Budget 2025 creates multiple cash flow pressure points.

Higher wages, increased dividend tax and adjusted allowances all affect working capital.

Proactive cash flow management becomes critical for business survival.

Regular forecasting identifies potential shortfalls before they become crises.

Cash Flow Strategies:

- Model all Budget changes into 12-month forecasts

- Adjust pricing to maintain margin despite cost increases

- Accelerate invoice collection to improve working capital

- Review supplier payment terms for flexibility

- Establish overdraft facilities before need arises

Professional accountants provide sophisticated cash flow modelling tools.

Year-End Planning Considerations

Tax year-end planning takes on added importance with Budget 2025 changes.

Businesses should maximise capital allowance claims before April 2026 rate reductions.

Dividend extraction timing affects tax liabilities given April 2026 rate increases.

Capital expenditure timing can optimise new first-year allowance benefits.

Action Checklist:

- [ ] Review capital expenditure plans for allowance optimisation

- [ ] Model salary-dividend extraction for 2025/26 and 2026/27

- [ ] Assess business rates relief eligibility from April 2026

- [ ] Prepare for MTD compliance requirements

- [ ] Evaluate pension contribution strategies before 2029 cap

Year-end planning requires expertise that outsourced accounting naturally provides.

Technology Requirements for Post-Budget Compliance

HMRC changes 2025 small businesses face demand robust technology infrastructure.

MTD-compatible software becomes non-negotiable for most businesses.

Cloud-based systems offer flexibility, security and automatic updates.

Integration between accounting, payroll and banking streamlines operations.

Essential Technology Features:

- MTD Compliance: Direct HMRC submission capability

- E-Invoicing Ready: Future-proof for 2029 requirements

- Bank Feeds: Automated transaction import

- Multi-User Access: Team collaboration capabilities

- Real-Time Reporting: Dashboard analytics and KPIs

- Mobile Access: On-the-go financial management

Outsourced accounting for small businesses typically includes appropriate software.

Regional Variations

Budget 2025 provisions apply differently across UK nations.

Business rates changes affect England directly.

Scotland and Wales receive mechanisms to set property income rates.

Northern Ireland maintains separate arrangements for some measures.

Devolved Considerations:

- Property income tax rates may vary in Scotland and Wales

- Business rates systems differ across nations

- Some welfare changes (like two-child limit removal) require local adoption

Small business accounting must account for appropriate jurisdictional rules.

Conclusion: Navigating the 2025 Budget Successfully

The autumn budget 2025 creates significant challenges for small businesses. Multiple tax changes, compliance updates and workflow adjustments demand attention. However, strategic planning and professional support enable successful navigation.

The budget impact on small businesses varies by sector and structure. Understanding changes and implementing responses early provides competitive advantage.

Outsourced accounting for small businesses offers expertise, efficiency and peace of mind. As tax complexity increases, professional partnerships become business necessities rather than luxuries.

Small business accounting success in 2026 and beyond requires proactive adaptation. Start planning now to capitalise on reliefs whilst minimising additional costs. The right accounting partner transforms regulatory burden into growth opportunity.

FAQs: 2025 Budget and Small Business Accounting

How do I update cash flow forecasts after budget changes?

Start by identifying all relevant changes affecting your business. Model wage increases, dividend tax rises and business rates relief. Project implementation dates for each change into monthly forecasts. Use accounting software or spreadsheets to create scenario analyses.

How does the 2025 UK Budget affect SME accounting workflows?

The Budget creates multiple workflow adjustments across different dates. Digital reporting requirements expand under MTD from April 2026. E-invoicing preparation must begin now for 2029 implementation. Different tax changes require separate tracking and implementation.

What are small business bookkeeping workflow adjustments for 2025?

Quarterly digital submissions become standard under expanded MTD. Electronic record-keeping replaces paper-based systems. Real-time tax calculations require integrated accounting software. More frequent reporting cycles demand streamlined processes.

How do I manage new tax workflows after Budget 2025?

Create a calendar marking all change implementation dates. Assign responsibility for tracking and implementing each change. Update accounting systems to handle new calculations. Train staff or engage professionals familiar with changes.

What workflow automation helps small businesses post-Budget 2025?

Automated bank feed integration eliminates manual transaction entry. Rule-based transaction categorisation speeds bookkeeping. Digital receipt capture via mobile apps improves record-keeping. Automated VAT calculations and returns ensure accuracy.

Which HMRC changes affect small businesses most in 2025?

Dividend tax increases directly impact owner-manager income from April 2026. Capital allowance adjustments affect investment decisions throughout 2026. Business rates relief delivers significant savings from April 2026. MTD expansion brings compliance obligations for more businesses.

Do I need new software for 2025 tax compliance updates?

Most businesses need MTD-compatible accounting software. Existing platforms often require upgrades for full compliance. E-invoicing capability becomes mandatory by April 2029. Cloud-based systems offer easier updates than desktop software.

How does outsourced accounting help with Budget changes?

Professional accountants monitor all relevant regulatory changes. They implement updates systematically across client portfolios. Technical expertise ensures accurate application of new rules.

Proactive planning maximises reliefs and minimises liabilities. Regular communication keeps business owners informed.

What’s the timeline for implementing Budget 2025 changes?

January 2026 introduces new capital allowances and VAT changes. April 2026 brings dividend tax rises, wage increases and business rates relief. April 2027 implements separate property income tax bands. April 2029 mandates e-invoicing for VAT and caps pension salary sacrifice.

Should small businesses outsource accounting after Budget 2025?

Increased complexity makes professional support more valuable. Cost of in-house management often exceeds outsourcing fees. Expertise requirements exceed typical small business capabilities. Technology investments burden small operations disproportionately.

Parul is a content specialist with expertise in accounting and bookkeeping. Her writing covers a wide range of accounting topics such as payroll, financial reporting and more. Her content is well-researched and she has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.