UK pension reforms from April 2025 introduce higher employer National Insurance (15%), lower earnings thresholds (£5,000), real-time tax code updates, and mandatory payroll processing of benefits-in-kind. The reforms also allow greater access to defined benefit pension scheme surpluses and tighten auto-enrolment compliance, with fully digital PAYE submissions required from April 2026. These changes significantly increase payroll complexity and compliance obligations for UK employers.

The 2025-26 Pension Reforms aren’t just another regulatory update. They’re fundamentally reshaping how payroll operates, how pensions are managed and how businesses handle compliance.

For UK employers managing payroll in-house or through accounting firms, these reforms will directly impact operations. The question isn’t whether you’ll be affected, it’s whether you’ll be ready.

Let’s break down what’s coming and the impact of UK pension reforms 2025 on payroll outsourcing and why payroll outsourcing might be your smartest move.

UK Pension Reforms 2025: What’s actually changing?

Following the government’s recent announcements, several major pension and payroll reforms are rolling out. While ministers talk about “unlocking billions” and “driving growth,” for businesses, it means more complexity, more admin, more oversight.

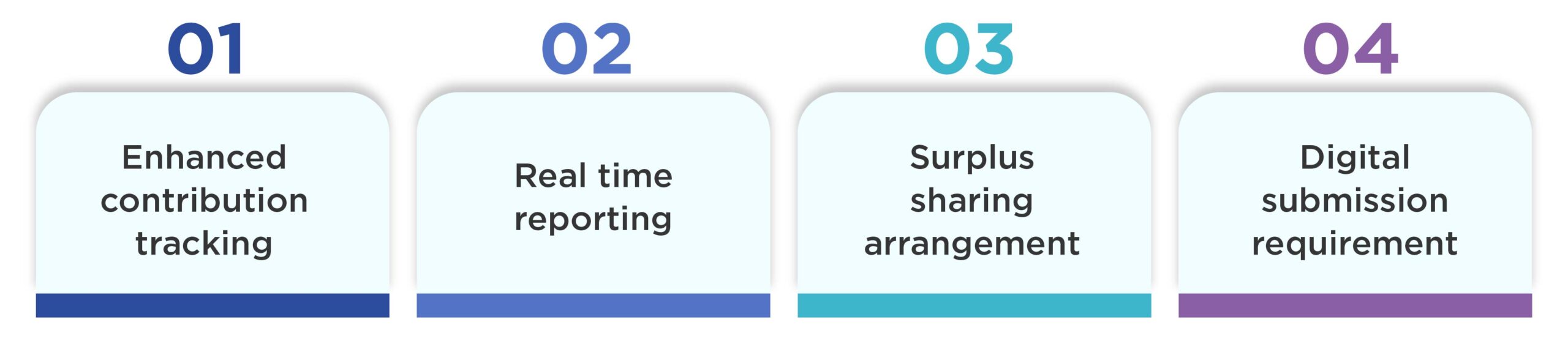

Here are the changes hitting your payroll operations:

Benefit of Pension surplus access From 2025, well-funded occupational defined benefit pension schemes can access their surplus funds more flexibly. Approximately 75% of schemes hold surplus worth £160 billion that was previously trapped by restrictions.

Trustees and sponsoring employers can now use this money to boost productivity, increase wages, or enhance pension benefits. But this means your payroll systems must handle complex surplus sharing calculations.

Employer National Insurance Rate changes Starting April 2025, employer NIC rates rise by 1.2 percentage points to 15%. The earnings threshold drops from £9,100 to £5,000, hitting low-wage sectors hardest over 4% increased costs for bottom fifth earners versus 1.5% for top earners.

Benefits in kind through Payroll P11D forms are being phased out. All benefits-in-kind must now be processed through payroll systems with real-time reporting. Your payroll software needs updates to handle this accurately.

Real time Tax code updates HMRC will push tax code changes in real-time. Employers must apply these immediately. Delays create compliance issues and unhappy employees.

Digital only PAYE Submissions From April 2026, manual or paper PAYE submissions end. Everything goes digital. No exceptions.

Stricter Employer obligations Enhanced checks on right-to-work documentation, pension auto enrolment compliance, and minimum wage adherence. Higher penalties for mistakes. Faster interest on late payments.

Why these reforms matter for small & mid-sized UK businesses

- Rising NIC costs hit SMEs harder than large employers.

- Real-time HMRC compliance means less room for mistakes.

- Small in-house payroll teams risk overwhelm without tech + expertise.

| Reform Area | Implementation Date | Compliance Impact |

| NIC Rate Changes | April 2025 | Immediate payroll recalculation |

| Benefits-in-Kind | April 2025 | System updates required |

| Real-Time Tax Codes | April 2025 | Instant application needed |

| Digital PAYE Only | April 2026 | Complete system overhaul |

| Enhanced Penalties | Ongoing | Higher error costs |

UK Pension Reforms 2025 Payroll Outsourcing

This isn’t just HMRC tightening rules. It’s about your business needing to:

- Invest in new payroll technology

- Train staff on complex regulations

- Handle real-time compliance monitoring

- Manage pension surplus calculations

- Process benefits through payroll systems

- Apply tax code changes instantly

That’s massive added pressure. Especially if your team’s already stretched or payroll isn’t your main focus.

Your clients and employees will expect faster, more accurate, more proactive service than ever.

The tech challenge: What your systems need

There’s software for everything, but the right payroll tech stack must:

- Connect seamlessly with HMRC APIs

- Handle real-time tax code changes

- Process complex pension calculations

- Manage benefits-in-kind reporting

- Ensure digital-only submissions

- Provide audit trails for compliance

According to research, 64% of UK accounting firms still use spreadsheets for payroll processing. That’s a compliance disaster waiting to happen in 2025-26.

Choose systems that integrate properly with HMRC and your existing processes. And ensure your team actually wants to use it training fatigue is real.

Auto enrolment changes 2025: What’s new

Auto enrolment thresholds 2025 bring stricter monitoring requirements. The reforms expand workplace pensions UK compliance beyond simple contribution calculations.

Employers must now manage:

Auto enrolment changes 2025 affect every employer with workplace pensions. The complexity demands specialist expertise most internal teams lack.

Impact of Pension Reforms on Payroll

The impact of Pension Reforms on payroll goes far deeper than contribution percentages. You’re looking at:

Calculation Complexity Pension surplus sharing creates multiple calculation scenarios. Your payroll systems must handle varying arrangements for different employees and schemes.

Compliance Monitoring Real-time reporting means instant compliance checking. Errors show up immediately, demanding quick corrections.

Administrative Burden Benefits-in-Kind processing through payroll adds significant admin work. P11D elimination means everything flows through your payroll system.

Penalty Risk Stricter deadlines and higher penalties make errors expensive. Late submissions cost more, and interest accrues faster on late payments.

Why Payroll Outsourcing UK 2025 makes sense now?

If managing this complexity internally feels overwhelming, you’re not alone. That’s why payroll outsourcing UK 2025 is becoming the smart choice.

With a reliable outsourced payroll services UK partner, you can:

- Focus on core business while specialists handle compliance

- Access expert systems without massive tech investments

- Reduce error risk through professional oversight

- Scale easily without hiring specialist staff

- Sleep better knowing compliance is handled

Real numbers: UK businesses spend 7-12 hours monthly per employee on payroll tasks. Outsourcing cuts this by 60-70% through efficient processes and automation.

Your business keeps client relationships. Behind the scenes, specialists handle the complexity from pension calculations to HMRC submissions.

UK Payroll Compliance 2025: The new standards

UK payroll compliance 2025 sets higher bars for accuracy and timeliness. The reforms create multiple compliance touchpoints:

Pension Law Changes UK Surplus access rules require careful management. Trustees and employers must agree arrangements while maintaining member benefit security.

Employer Obligations Pensions UK Enhanced responsibilities include surplus sharing oversight, contribution accuracy, and benefit reporting compliance.

Digital Submission Standards All communications with HMRC must meet digital standards. Manual processes become non-compliant from April 2026.

Pension Compliance Outsourcing: Professional advantage

Pension compliance outsourcing addresses the expertise gap most businesses face. Professional providers offer:

- Specialist Knowledge: Teams focused solely on pension regulations

- Advanced Systems: Technology designed for complex calculations

- Compliance Monitoring: Continuous oversight and error prevention

- Regulatory Updates: Automatic implementation of rule changes

The cost comparison favours outsourcing. Internal specialist hiring, training, and system maintenance often exceeds outsourcing fees without the expertise guarantee.

Implementation timeline: When changes hit

April 2025

- NIC rate increases to 15%

- Earnings threshold drops to £5,000

- Benefits-in-Kind through payroll begins

- Real-time tax code updates start

Throughout 2025

- Pension surplus access rules take effect

- Enhanced compliance monitoring

- Stricter penalty enforcement

April 2026

- Digital-only PAYE submissions mandatory

- Manual processing becomes non-compliant

Start preparing now. Waiting until implementation creates rushed transitions, training gaps, and error risks.

Common questions about the 2025 Reforms

Will my current payroll software handle these changes? Probably not without significant updates. Check real-time reporting capabilities, HMRC integration, and pension calculation features.

What happens if we don’t comply? Higher penalties, interest charges, and potential HMRC investigations. Non-compliance becomes expensive quickly.

How much does outsourcing cost compared to internal processing? Typically 30-50% less when factoring in specialist hiring, system upgrades, training, and compliance risk costs.

Can we maintain client relationships with outsourced payroll? Yes, through white-label services. You remain the client contact while specialists handle backend processing.

When should we start preparing? Now. April 2025 arrives faster than expected, and rushed implementations create problems.

The strategic choice: Adapt or struggle

Running a business today is challenging enough. HMRC’s reforms make payroll significantly more complex and risky.

But this creates strategic opportunities. Firms adapting early gain competitive advantages through efficient compliance and reduced operational burden.

Meanwhile, businesses that wait face:

- Last-minute implementation pressure

- Higher compliance costs

- Increased error risks

- Staff overload

- Client service disruption

2025-26 represents the biggest UK payroll compliance shift in decades. Success depends on preparation and expertise exactly what professional outsourcing provides.

Conclusion

Smart businesses are already planning their transitions. The reforms aren’t distant threats they’re immediate challenges requiring professional solutions.

Outsourcing provides the expertise, technology, and support needed to thrive under the new regulations. Internal teams struggle with the complexity while professional providers specialise in exactly these challenges.

The choice is clear: invest heavily in internal capabilities you might not need long-term, or access professional expertise that keeps you compliant and competitive.

FAQs

What are the main UK Pension Reforms affecting payroll in 2025?

Defined benefit surplus access, increased NIC rates (15%), lower thresholds (£5,000), benefits-in-kind through payroll, and real-time tax code updates.

When do auto enrolment changes 2025 take effect?

April 2025 for most changes, with digital-only submissions mandatory from April 2026.

How does pension compliance outsourcing work?

Professional providers handle all calculations, reporting, and compliance while maintaining your business relationships and branding.

What’s the cost of not adapting to these reforms?

Higher penalties, late payment interest, compliance failures, and potential business disruption through HMRC intervention.

Can small businesses handle these changes internally?

Most struggle without significant investment in systems and specialist staff. Outsourcing often provides better results at lower cost.

How long does payroll outsourcing implementation take?

Typically 3-6 months for complete transitions, depending on business complexity and current system status.

What happens to our existing client relationships?

White-label outsourcing maintains all client relationships while providing professional backend support.

Is the investment in new payroll systems worthwhile?

For most businesses, outsourcing provides better ROI than internal system investments, especially considering ongoing maintenance and update costs.

The Pension Reforms are coming whether you’re ready or not. The businesses that prepare now will thrive. Those that wait will struggle.

Is payroll outsourcing cost-effective for small UK businesses?

Yes. For businesses under 50 staff, outsourcing is often cheaper than software + staff training. Providers charge per payslip or per employee, keeping costs predictable.

Need help with UK Pension Reforms 2025?

Stay compliant and reduce payroll risk speak with our payroll & pension compliance team for a free initial assessment.

Book a free compliance reviewParul is a content specialist with expertise in accounting and bookkeeping. Her writing covers a wide range of accounting topics such as payroll, financial reporting and more. Her content is well-researched and she has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.