Making Tax Digital represents the biggest change to Self Assessment in 30 years. This digital transformation requires businesses to maintain electronic records and submit updates quarterly.

HMRC digital records replace traditional paper-based bookkeeping for eligible taxpayers from April 2026. The system aims to reduce errors and make tax compliance simpler for businesses.

Understanding MTD requirements helps you prepare for this mandatory digital transition ahead.

Key takeaways

- From April 2026, sole traders and landlords with income over £50,000 must keep digital records and submit quarterly updates to HMRC.

- The income threshold for mandatory MTD compliance lowers to £30,000 from April 2027, expanding the scope.

- All digital records must be kept using HMRC-recognised software that links directly to HMRC systems for seamless reporting.

- Quarterly updates replace the traditional annual Self Assessment, with a final declaration submitted by 31 January each year.

- MTD helps reduce errors, saves time with spread-out reporting, and improves financial visibility for better business planning.

What is Making Tax Digital for Self Assessment?

MTD Self Assessment requires sole traders and landlords to keep digital business records. You must use HMRC-recognised software to record income and expenses throughout the year.

The system replaces annual Self Assessment with quarterly digital updates to HMRC. MTD compliance for Self Assessment involves submitting four quarterly updates plus annual declarations.

This is not a new tax but a new method of reporting existing obligations.

Who needs to follow MTD requirements?

Not everyone needs to start using MTD straight away. It depends on how much money you earn from your business or rental properties. HMRC is bringing people in gradually based on their income levels.

Income thresholds for mandation

From April 2026, sole traders and landlords earning over £50,000 must comply. From April 2027, the threshold lowers to £30,000 for qualifying business income.

Those earning below £30,000 can join voluntarily but aren’t currently mandated.

| Start Date | Income Threshold | Who Must Comply |

|---|---|---|

| 6 April 2026 | Over £50,000 | First wave: sole traders and landlords |

| 6 April 2027 | Over £30,000 | Second wave expansion |

| Under review | Below £30,000 | Voluntary sign-up available |

Exempt businesses and individuals

Limited companies already file Corporation Tax returns and remain outside MTD scope. Partnerships will join MTD in a future phase, earliest from 2027 onwards. Trusts and deceased estates are exempt unless trustees have separate qualifying income.

Digitally excluded individuals can request exemption if they cannot engage with technology. Foster carers and those without National Insurance numbers are also exempt.

How to keep digital records for Self Assessment?

Digital record keeping means storing your business information on a computer or mobile device instead of on paper. You need to record every sale you make and every expense you pay. The records must be kept in special software that can connect to HMRC’s system.

Creating Self Assessment digital records

You must create digital records of your self-employment and property income and expenses. Digital records must include the transaction amount, date received and appropriate category.

Record income such as sales, takings, fees, rent and property premiums digitally. Record expenses including stock costs, travel, office costs and financial charges digitally.

MTD record keeping uses the same income and expense categories as Self Assessment.

Requirements for digital bookkeeping

All business records must be stored electronically using compatible accounting software. You must continue keeping original receipts and supporting documents as usual.

Digital records must be created as close to the transaction date as possible. Records must be kept for at least five years after 31 January deadline.

You cannot manually copy or paste records between software once submitted to HMRC.

Accounting software for MTD compliance

To follow MTD rules, you need to use special accounting software. This software keeps your records safe and sends them to HMRC automatically. There are many different types of software available and some are free whilst others cost money.

Types of compatible software

Software packages allow you to create records and submit returns directly to HMRC. Bridging software connects spreadsheets to HMRC’s system for quarterly submissions.

API spreadsheets have built-in functions to file returns through HMRC’s interface. You can use one comprehensive software or multiple products working together digitally.

Best accounting tools for MTD Self Assessment

Free options include Sage Individual, FreeAgent (for some users) and Clear Books. Paid solutions include Xero, QuickBooks, FreeAgent, Hammock and IRIS products.

Popular choices are QuickBooks Online, Xero, FreeAgent, Kashflow and Clear Books. Bridging software options include TaxCalc, 123 Sheets and Self Assessment Direct.

Check HMRC’s software list for all compatible products available.

| Software | Type | Free Version | Best For |

|---|---|---|---|

| Sage Individual | Full package | Yes | Individual sole traders |

| Xero | Full package | No | Growing businesses |

| QuickBooks Online | Full package | No | Established businesses |

| FreeAgent | Full package | Some users | Freelancers and agents |

| Hammock | Full package | No | Landlords specifically |

| TaxCalc Bridge | Bridging | No | Spreadsheet users |

| Clear Books | Full package | Limited | Small businesses |

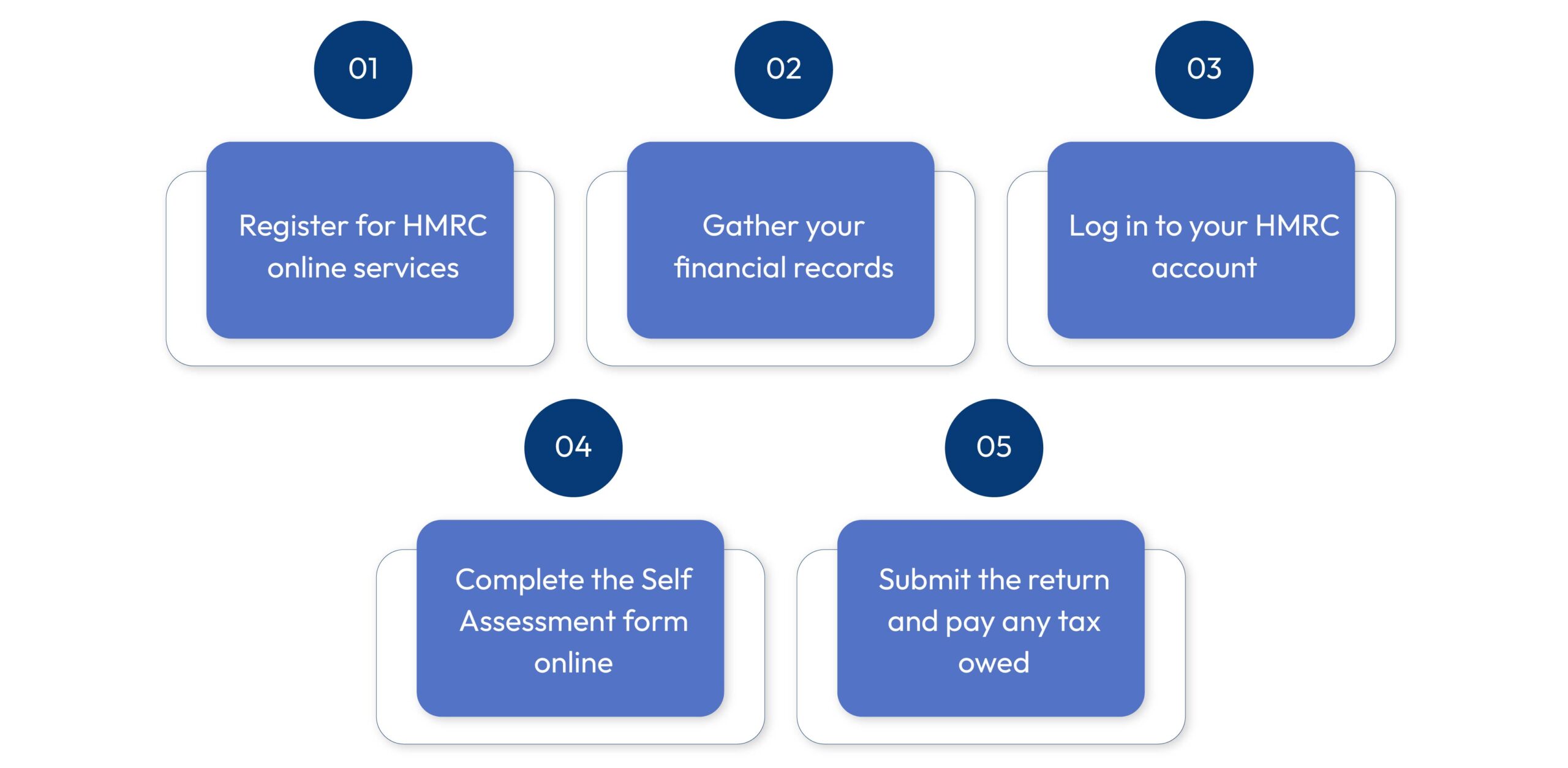

Step-by-step guide to MTD compliance for Self Assessment

Getting started with MTD might seem difficult, but if you follow the steps carefully, it becomes much easier. First, you need to work out if you must join and when. Then you pick your software and set everything up properly before your start date arrives.

Preparing for MTD requirements for individuals

Check your total qualifying income from self-employment and property sources. Determine whether you must join in April 2026, 2027, or remain voluntary.

Choose compatible software that meets your business needs and recording preferences. Sign up through your software provider, not through HMRC’s website directly.

Allow time to familiarise yourself with digital record keeping before mandation.

Setting up your digital records

Decide your accounting method: cash basis or traditional accounting basis. Choose your accounting period to align with the tax year or calendar.

Set up separate digital records for each self-employment business you operate. Create one UK property business record for all UK rental properties.

Create one foreign property business record for all overseas rental properties.

How to submit Self Assessment digitally?

Record income and expenses digitally throughout each quarterly update period. Submit quarterly updates by the deadline: 5 August, 5 November, 5 February, 5 May.

Each quarterly update shows cumulative income and expenses for the year. Complete your final declaration including all other taxable income by 31 January.

You cannot use HMRC’s website to submit your digital Self Assessment return.

What records do I need for MTD Self Assessment?

You need to keep records of all money coming into your business and all money going out. This includes every sale, every bill you pay and every expense you have.

The type of records depends on whether you’re self-employed or a landlord, but both need to track income and expenses carefully

Business income records required

Self-employment income includes sales, takings, fees and business receipts from customers. Property income includes rent received, lease premiums, reverse premiums and inducements.

You must record the amount, date received and category for all income. Create separate records for UK property versus foreign property rental income.

If turnover exceeds £90,000, you must categorise income in full detail.

Allowable expense records needed

Business expenses include stock costs, travel expenses, office costs and finance costs. Property expenses include repairs, maintenance, management fees and insurance costs.

Record the amount spent, date incurred and expense category for everything. Residential property landlords must separate residential finance costs from other expenses.

Keep digital records of disallowable expenses if you currently track them.

Records you don’t need digitally

Employment income from PAYE does not require digital record keeping currently. Partnership income is reported through the partnership, not individual MTD records.

Dividend income and savings interest aren’t required in digital business records. You can optionally include these in your software for complete tracking.

Digital bookkeeping tips for success

Keeping good digital records doesn’t have to be hard work. There are simple ways to make the job easier and quicker. Following these tips will help you stay on top of your bookkeeping and avoid common mistakes that many people make.

Simplifying your record keeping

Retailers can record daily gross takings instead of each individual sale. Landlords under £90,000 can use simpler income and expense categorisation rules.

Joint landlords only record their share of income and expenses digitally. Consider using simplified expenses schemes if eligible for your business.

Create records regularly rather than leaving everything until quarterly deadline approaches.

Linking your software correctly

You must digitally link records between your record-keeping software and bridging software. Acceptable methods include linked spreadsheet cells, CSV imports and API transfers.

Email spreadsheets to import data or transfer files via USB devices. Never manually copy, cut, or paste records after submitting to HMRC.

Common mistakes in MTD digital record keeping

Not creating digital records close enough to the actual transaction date. Manually copying records between software instead of using digital linking methods.

Failing to keep records for the required five-year period after deadline. Not categorising expenses correctly when turnover exceeds £90,000 VAT threshold.

Forgetting to keep original receipts and supporting documents alongside digital records.

Benefits of Making Tax Digital for Freelancers and Small Businesses

MTD helps your business in several ways. Using software means fewer mistakes with your numbers and less stress at tax time.

Many businesses find they save time overall and understand their finances better when they use digital records.

Reduced errors and improved accuracy

Software automatically calculates totals, reducing potential for mathematical calculation errors. Digital linking eliminates manual data entry mistakes between different record systems.

Quarterly updates catch errors early rather than discovering problems at year-end. Real-time recording means fewer missing transactions or forgotten income entries.

HMRC estimates the tax gap for Self Assessment businesses at £5 billion annually.

Time savings and efficiency gains

Spreading admin across the year makes tax preparation less overwhelming overall. Software automates calculations that previously required manual addition and subtraction.

Quarterly submissions mean your year-end return requires minimal additional work. Cloud-based software allows you to record transactions anywhere using mobile devices.

Evidence from MTD for VAT shows businesses save time and gain confidence.

Better financial visibility and planning

Quarterly updates provide clearer view of your tax liability throughout year. Real-time records help with cash flow management and business decision-making.

Understanding your tax position earlier allows better planning for payment dates. Software reports show profitability trends and expense patterns more clearly.

Digital tools often integrate with invoicing and payment tracking systems automatically.

HMRC Self Assessment online filing changes

The way you report your taxes to HMRC is changing completely. Instead of one annual tax return, you’ll send four quarterly updates during the year.

You’ll still do a final declaration in January, but most of the work will already be done through your quarterly updates.

Quarterly update requirements

You must submit four quarterly updates showing cumulative income and expenses. Deadline dates are fixed: 5 August, 5 November, 5 February and 5 May.

Each update includes all transactions from the start of the tax year. You can correct previous quarters by including adjustments in subsequent updates.

Late submission penalties don’t apply during the testing phase currently.

Final declaration process

The final declaration replaces your traditional SA100 Self Assessment tax return. Submit by 31 January following the tax year, same as current deadline.

Include all other income sources like employment, savings and dividend income. Declare capital gains, pension contributions and claim reliefs in final declaration.

Your accounting software must support both quarterly updates and final declarations.

UK tax digitalisation timeline

HMRC is bringing in MTD gradually over several years. This gives people time to get ready and choose their software. The start date for you depends on how much money your business makes each year.

Key implementation dates

Public beta testing began in 2025 for voluntary early adopters. 6 April 2026: Mandatory for income over £50,000 from self-employment or property.

6 April 2027: Mandatory threshold lowers to £30,000 qualifying income. Future date under review: Potential mandation for those under £30,000 income.

| Milestone | Date | Details |

|---|---|---|

| Public beta testing | 2025 onwards | Voluntary sign-up available |

| First mandation | 6 April 2026 | Income over £50,000 |

| Second mandation | 6 April 2027 | Income over £30,000 |

| Partnerships | 2027+ earliest | Future phase planned |

| Below £30,000 | Under review | No mandation date set |

Costs and impacts

Average transitional cost per business estimated at £320 for setup. Average annual additional cost estimated at £110 per business for compliance.

HMRC IT costs expected around £500 million to end of March 2028. Software and agent costs for business purposes are tax deductible expenses.

Around 780,000 people will join from April 2026 with 970,000 following.

Working with agents and accountants

Many people use accountants or bookkeepers to help with their taxes. Your accountant can use MTD software on your behalf if you prefer. You need to give them permission to access your MTD records and send updates to HMRC for you.

Agent responsibilities under MTD

Agents can create digital records and submit quarterly updates on behalf. Your accountant needs your permission to manage MTD submissions for you.

Discuss software options with your agent as they may already use compatible systems. Agents can help you choose between creating your own records or delegating.

Some bookkeepers can submit quarterly updates; verify capabilities with your bookkeeper.

Authorising your agent

You must authorise your agent through your compatible software to act. Check HMRC guidance on signing up agents for detailed instructions.

Agents can attend HMRC webinars and events specifically designed for professionals. Your agent can correct digital records and resend quarterly updates if needed.

Multiple businesses and property portfolios

If you have more than one business or several rental properties, you need to organise your records carefully.

Each different business needs its own set of records, but all your rental properties in the UK go together in one record. This keeps everything organised and makes it easier to send your updates.

Separate records for each business

Create one set of digital records for each self-employment income source. For example, electrician work and driving instruction need separate digital records.

All UK rental properties combine into one UK property business record. All foreign rental properties combine into one foreign property business record.

Send separate quarterly updates for each distinct business income source.

Joint property lettings

Record only your share of income and expenses from jointly-let properties. You don’t need to digitally link your records to co-landlords’ records.

Optionally use simpler categorisation for jointly-let properties to reduce admin. You may exclude joint property expenses from quarterly updates if preferred.

If excluded, create expense records before finalising Income Tax position at year-end.

Software setup and technical requirements

Choosing the right software is important because you’ll use it regularly to keep your records.

The software needs to work with your bank accounts and handle all your different types of income. Make sure it can do everything you need before you commit to using it.

Choosing the right software

Consider how you’ll track business income and expenses in your workflow. Some software connects to bank accounts for automatic transaction capture.

Check whether software supports your accounting period if not standard 6 April. Ensure software can handle all your income sources: self-employment, UK, foreign property.

Free software products are available for smallest businesses with straightforward affairs.

Digital linking requirements

Records in spreadsheets must digitally link to bridging software for submissions. You can use linked cells, formulas, CSV exports, or API connections.

Set up digital links before sending your first quarterly update to HMRC. Once records are sent to HMRC, never manually move them between software.

Changing software during the year

Import digital records into new compatible software for the current year. Alternatively, recreate all current year records in your new software from scratch.

If using bridging software, link new bridging software to existing record-keeping system. After tax year ends, securely store old records but don’t need to import them.

Special situations and simplifications

Some businesses can use simpler rules for their records. If your turnover is below certain levels, you don’t need to put as much detail in your records. There are also special rules for people who use simplified expenses schemes or receive income from trusts.

Turnover below VAT threshold

If under £90,000, sole traders only need to record transactions as income or expense. Landlords under £90,000 must still separate residential finance costs from other expenses.

Once turnover exceeds £90,000, categorise all records in full detail immediately. Apply detailed categorisation from start of current tax year going forward.

If you use simplified expenses

Don’t create digital records of actual expenses if certain you’ll use simplified schemes. If unsure, create digital records of all actual expenses to maintain flexibility.

Learn more about simplified expenses schemes before deciding your approach.

Estimated income from trusts

If notified after quarterly deadline, either estimate income then confirm later. Or send nil returns during year and record confirmed income when notified.

Update the digital record when income is confirmed for next quarterly update. If after fourth update, resend that update to include confirmed income amount.

Exemptions from MTD requirements

Not everyone has to use MTD. If you cannot use computers or digital technology, you can ask HMRC for an exemption. This means you can continue doing your tax returns the old way.

People with certain disabilities or those living in areas with no internet can also get exemptions.

Digital exclusion exemptions

You can request exemption if cannot engage with HMRC through mandatory digital channels. Exemptions mirror those for MTD for VAT operating since April 2019.

Apply for exemption through non-digital means: in writing or by telephone. Those already exempt from other HMRC digital requirements are automatically exempt.

Accessibility support available

HMRC works with MTD Accessibility Working Group and Additional Needs Working Group. Software developers create products for those with cognitive, motor, visual, hearing difficulties.

Extra Support service available for those needing additional help. Multiple support channels include telephony support, webchat and accessible online content.

Rural location exemptions available where internet access isn’t feasible for operations.

Monitoring your compliance status

Staying on top of your MTD responsibilities means checking your records regularly. Make sure you’re creating records soon after each transaction happens. If you find any mistakes, you can fix them before sending your next quarterly update to HMRC.

Record keeping during the year

Create digital records before the quarterly update deadline for that period. Or before sending the quarterly update if submitting earlier than the deadline.

Don’t need to catch up immediately if joining partway through the year. Regularly review records to ensure all income and expenses are captured.

Correcting errors and omissions

Change, delete, or create digital records to correct any discovered mistakes. Corrections made during tax year are included in next quarterly update automatically.

After fourth quarterly update, correct by resending fourth update with amendments. Or adjust category totals in software whilst updating your underlying digital records. Make corrections as soon as possible after discovering errors or omissions.

Government support and resources

HMRC provides lots of help to get you ready for MTD. Their website has guides, videos and lists of approved software. You can also attend online training sessions or contact HMRC directly if you have questions about how MTD affects you.

Official HMRC guidance

Visit Making Tax Digital campaign website for comprehensive information and updates. Access detailed technical guidance on creating digital records and submissions.

Check software compatibility list regularly for new additions. Review digital record-keeping notice for detailed requirements.

Contact HMRC at makingtaxdigital.consultations@hmrc.gov.uk for specific questions about changes.

Additional support channels

Attend HMRC webinars and recorded sessions available on YouTube and e-learning. Access GOV.UK help pages signposting information, guides and local digital skills courses.

Third-party software providers offer support services for their specific products. Agents and accountants provide professional guidance for clients joining MTD.

Preparing for your digital transition

Starting to prepare now will make the change to MTD much less stressful. Work out when you need to start based on your income levels. Look at different software options and try them out before you have to start using them for real.

Steps to take now

Calculate your total qualifying income from all self-employment and property sources. Determine your mandation date based on income threshold: 2026, 2027, or voluntary.

Research compatible software options and compare features, costs and user reviews. Consider voluntary early adoption to become familiar with system before mandate.

Discuss MTD requirements with your accountant or bookkeeper if you use one.

Getting software ready

Obtain HMRC-recognised software well before your mandation date to allow setup time. Enter your business name, start date, email, National Insurance number, accounting details.

Set up digital record categories matching your business structure and income types. Practice creating digital records and linking software if using bridging solutions.

Test quarterly update submission during voluntary period before becoming mandatory.

Conclusion

Review your total qualifying income to determine when MTD becomes mandatory. Research compatible software options and compare features, costs and user experiences. Sign up voluntarily before your mandation date to familiarise yourself with system.

Arrange appropriate support from accountants, bookkeepers, or software providers if needed. Keep updated with HMRC’s official guidance as implementation approaches for your threshold. MTD represents a significant change but offers benefits through reduced errors and time savings.

Preparing early ensures smooth transition to digital record keeping and quarterly submissions. Compatible software and support systems are available to help every business succeed.

Frequently asked questions

What is Making Tax Digital and how does it work?

Making Tax Digital requires businesses to keep digital records and send quarterly updates. You use HMRC-recognised software to record income and expenses throughout the tax year. Submit four quarterly updates showing cumulative totals then final declaration by 31 January.

MTD aims to reduce errors, save time and modernise the tax system.

Do I need MTD compliance for Self Assessment this year?

If you earn over £50,000 from self-employment or property, mandation starts April 2026. If you earn over £30,000, mandation starts from April 2027 onwards. Below £30,000, you can join voluntarily but aren’t currently required to comply. Limited companies, partnerships (for now) and digitally excluded individuals are exempt.

How do I submit Self Assessment digitally under MTD?

Choose compatible accounting software that meets your business needs and budget. Sign up for MTD through your software provider using your business details. Create digital records of income and expenses using your chosen software regularly. Submit quarterly updates by deadlines: 5 August, 5 November, 5 February, 5 May. Complete final declaration by 31 January including all other taxable income sources.

What are the best accounting tools for MTD Self Assessment?

Free options include Sage Individual for basic needs and simple business structures. Paid solutions like Xero, QuickBooks Online and FreeAgent suit growing businesses. Landlords often prefer Hammock software designed specifically for property income. Bridging software like TaxCalc Bridge allows continued spreadsheet use with digital submissions. Compare features, costs and compatibility with your business before choosing software.

Can I use spreadsheets for MTD digital record keeping?

You can use spreadsheets if digitally linked to bridging software for submissions. Digital linking methods include linked cells, CSV imports, email transfers, USB transfers. Never manually copy or paste records between software after submitting to HMRC. Cloud-based software is recommended as safer than spreadsheets for record storage.

What records do I need for MTD Self Assessment?

Record all self-employment income: sales, takings, fees and business receipts received. Record all property income: rent, lease premiums, reverse premiums and inducements. Record all business expenses: stock, travel, office costs, repairs and finance costs. Include transaction amount, date received or incurred and appropriate income/expense category. Keep original receipts and supporting documents for five years alongside digital records.

When does Making Tax Digital become mandatory for me?

Check your total qualifying income from self-employment and property combined for threshold.

April 2026 if you earn over £50,000 from these sources annually. April 2027 if you earn between £30,000 and £50,000 from these sources. Below £30,000 remains voluntary until HMRC reviews whether mandation is proportionate.

What are the Benefits of Making Tax Digital for my business?

Reduced errors through automated calculations and digital linking between software systems. Better financial visibility with quarterly updates showing tax liability throughout year. Time savings by spreading admin across year instead of annual rush. Improved cash flow management through earlier understanding of upcoming tax bills. Software integration with invoicing, expenses and banking streamlines business admin overall.

What happens if I make mistakes in my digital records?

Correct errors by changing, deleting, or creating digital records in your software. Corrections during the year automatically include in your next quarterly update. After fourth quarterly update, correct by resending that update with amendments. Or adjust category totals in software whilst reflecting changes in underlying records. Make corrections as soon as possible after discovering errors or omissions.

Do I need an accountant for MTD compliance?

You can manage MTD yourself using compatible software if you’re comfortable. Accountants can create digital records and submit quarterly updates on your behalf. Many businesses find accountant support valuable especially during transition period to MTD. Discuss with your accountant about their MTD services and software they use. Software and accountancy costs for business purposes are tax deductible expenses.

Parul is a content specialist with expertise in accounting and bookkeeping. Her writing covers a wide range of accounting topics such as payroll, financial reporting and more. Her content is well-researched and she has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.