Getting payroll right is essential. In hospitality, where shifts change suddenly and staff handle different roles, payroll mistakes can quickly become serious problems. These payroll errors affect real people trying to pay their bills and manage their finances.

The hospitality sector faces particular payroll challenges. Restaurants, hotels and bars work with changing demand, irregular hours, seasonal peaks and frequent staff changes. When you add tips, different pay rates and complex overtime rules, payroll processing becomes difficult. Understanding common mistakes and putting practical solutions in place can save money, keep staff satisfied and ensure HMRC compliance.

Key Takeaways

- Track time accurately to avoid overtime and minimum wage errors.

- Use software for multiple pay rates and holiday calculations.

- Classify staff correctly as employees vs contractors.

- Handle tips via compliant tronc systems for tax compliance.

- Audit payroll quarterly to catch issues early.

- Outsource if internal expertise is limited.

Why Hospitality Industry Payroll is Particularly Challenging?

The hospitality industry operates differently from other sectors. These unique features create complexity in payroll for hotels and restaurants that requires careful management.

Staff rarely work the same hours each week. Last-minute shift changes, unexpected call-ins and seasonal changes create constant challenges for payroll teams calculating accurate wages. Timekeeping issues frequently arise when managing large teams across multiple shifts.

According to ONS data published in June 2025, the accommodation and food service sector experienced the largest decrease in payrolled employees, with a fall of 124,000 employees between May 2024 and May 2025. This high turnover creates continuous administrative work and makes maintaining accurate payroll records more challenging.

The Most Common Payroll Errors in Hospitality

Understanding the most frequent payroll mistakes helps hospitality businesses avoid them and ensure hotel payroll compliance. Here are the main errors commonly affecting this sector.

1. Inaccurate Time and Overtime Tracking

This creates the biggest source of payroll errors in hospitality. When staff record their arrival and departure at different times each day, work split shifts or pick up extra hours at short notice, accurate tracking becomes difficult without proper systems. Timekeeping issues are among the most common payroll challenges facing restaurant payroll management today.

Common problems include:

- Paper timesheets that get lost or damaged

- Staff forgetting to record their attendance

- Managers making mistakes when transferring hours manually

- Missed breaks and overtime not recorded properly

The UK has no legal overtime rate, but total pay must never fall below the National Minimum Wage. Meeting minimum wage rules and ensuring national minimum wage compliance requires careful attention, especially when staff work irregular hours. Many hospitality businesses offer enhanced rates like time-and-a-half during busy periods.

2. Managing Multiple and Varying Pay Rates

In hospitality, employees often perform multiple roles. A team member might work as a server during lunch, cover reception in the evening and help at the bar on weekends. Each role potentially has a different hourly rate.

Manual payroll processing struggles with this complexity. When someone works three different roles in one week, the risk of applying the wrong rate increases substantially. Without automated systems tracking these differences, payroll mistakes become almost certain.

3. Holiday Pay Miscalculations

Holiday pay errors cause significant problems, particularly for part-time and irregular hours workers. Workers on irregular hours must have their holiday pay calculated based on their average earnings over the previous 52 weeks where they were paid. This reference period must include overtime, tronc payroll payments and any other regular payments.

Common holiday pay errors:

- Using contracted hours only, excluding regular overtime

- Incorrect application of the 12.07% accrual method

- Including unpaid weeks in the 52-week reference period

- Forgetting to include tips paid through tronc schemes

- Miscalculating pro-rata entitlement for part-time staff

4. Employee Misclassification

The line between employee and self-employed contractor can sometimes blur in hospitality. However, getting this classification wrong has serious consequences for compliance hospitality businesses must maintain.

HMRC takes misclassification seriously because it affects tax revenue. Employees pay income tax through PAYE and both employer and employee National Insurance contributions.

Signs someone should be classified as an employee:

- They must personally carry out the work

- You control what, when, where and how they work

- You provide equipment and materials

- They work set hours or a minimum number of hours

- They receive regular wages rather than invoicing you

5. Tax and National Insurance Errors

Tax codes change regularly. National Insurance thresholds adjust annually. Staying current with these changes whilst processing payroll creates many opportunities for error. Meeting PAYE deadlines and maintaining HMRC compliance requires constant attention.

According to HMRC’s enforcement data, in 2024 to 2025, HMRC identified wage arrears of £5.8 million owed to more than 25,000 underpaid workers. HMRC also issued approximately 750 penalties worth £4.2 million. Employers who fail to comply with minimum wage rules can face penalties of up to 200% of the underpayments owed to workers.

6. Tips and Tronc System Complications

Since October 2024, the Employment (Allocation of Tips) Act requires all tips to be passed to staff fairly and transparently. Detailed records must be kept showing distribution.

Tips distributed through a compliant tronc scheme are not subject to National Insurance, but they are subject to income tax. Many hospitality businesses struggle with integrating tronc payroll into their systems whilst ensuring accurate tax treatment. Proper payroll records must track both regular wages and tronc distributions separately.

The Real Cost of Payroll Errors

Payroll mistakes cost far more than the immediate monetary discrepancy. The full impact affects multiple areas of your business.

Financial Penalties and Public Naming

HMRC compliance failures result in substantial penalties. According to the government’s enforcement and compliance report published in November 2025, up to Round 22 in October 2025, around 4,200 employers have been named since the scheme began. These employers have repaid over £55 million in arrears to over 560,000 workers.

According to HMRC’s, the most common causes of underpayments are pay deductions accounting for 34% of breaches and unpaid working time causing 31% of breaches.

Staff Retention, Administrative Burden and Reputation

When you underpay staff or pay them late, you damage the employment relationship. Staff leave, taking their training and experience with them.

Correcting payroll errors takes substantial time and diverts resources from revenue-generating activities. A reputation for payroll mistakes makes recruiting new staff harder.

How to Prevent Common Payroll Errors?

Preventing errors requires the right systems, processes and attention to detail. Following payroll best practices can help you avoid common mistakes.

Invest in Payroll Software

Purpose-built payroll software integrates with rota systems, time-tracking tools and HMRC reporting requirements to automate calculations. Cloud payroll software solutions in the UK offer particular advantages for multi-site hospitality operations, providing real-time access to payroll data from anywhere.

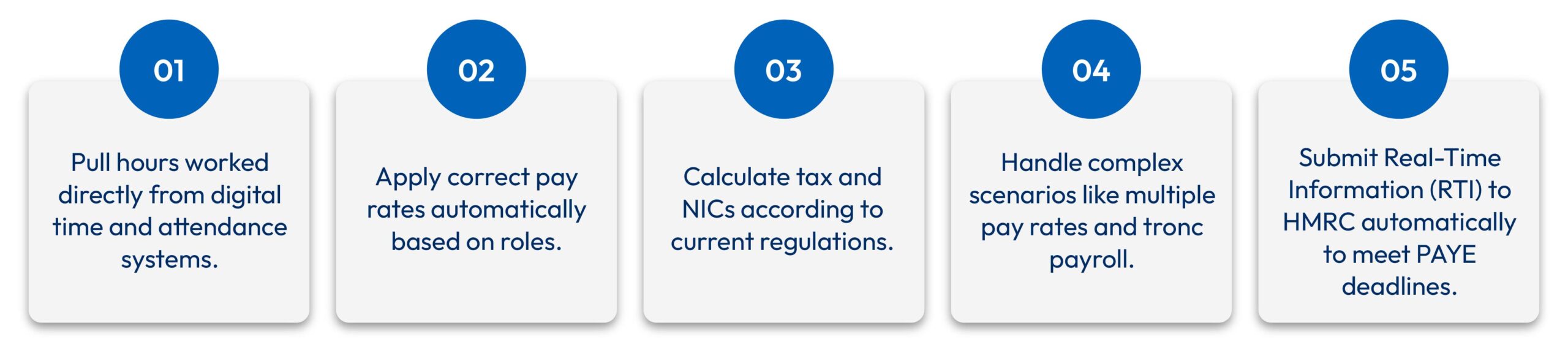

Good hospitality payroll software should:

Modern payroll software reduces manual errors and ensures consistent compliance hospitality businesses need to maintain.

Implement Digital Time-Tracking Systems

Replace paper timesheets with digital time and attendance systems. Digital systems create an accurate, timestamped record of when every team member starts and finishes work, helping to resolve timekeeping issues before they affect payroll processing.

Modern time-tracking integrates with scheduling software to flag potential overtime and export data directly to payroll systems, creating comprehensive payroll records.

Establish Clear Payroll Processes and Policies

Document every step of your payroll processing workflow. Your staff handbook should clearly explain pay rates for different roles, how overtime is calculated, holiday pay calculations, the tronc distribution process and when staff receive payslips. Clear policies form the foundation of payroll best practices.

Conduct Regular Payroll Audits

Schedule quarterly payroll audits to check that tax codes are current, National Insurance is calculated properly, holiday pay reflects actual earnings and wage payments meet national minimum wage compliance requirements. Regular reviews of payroll records help identify and correct errors before they become serious issues.

Stay Informed About Legislative Changes

Subscribe to HMRC updates and follow industry publications. National Minimum Wage rates adjust annually each April. Tax thresholds change in each Budget. PAYE deadlines and reporting requirements may also change, making it essential to stay current.

Consider Outsourced Payroll Services

Many hospitality businesses find that payroll outsourcing delivers better results than managing it internally. Outsourced payroll services handle everything from time and attendance integration to tax submissions, removing the burden of complex payroll processing from your internal team.

Payroll outsourcing works particularly well for:

- Businesses experiencing rapid growth

- Those lacking in-house payroll expertise

- Operations where administrative time is better spent on customer service

- Multi-site hotels and restaurants needing consistent processing

Professional providers stay current with all regulatory changes, use sophisticated cloud payroll software UK systems and understand the specific payroll challenges facing hospitality businesses. When evaluating outsourced payroll providers, look for those with specific experience in hospitality industry payroll, including tronc payroll management and compliance hospitality requirements.

Train Your Team

Everyone involved in payroll needs proper training. Key areas include employee classifications, overtime calculations, holiday pay requirements, tronc compliance and HMRC reporting obligations. Well-trained staff help prevent payroll mistakes before they occur.

Creating a Payroll Error Prevention Checklist

Regular checks help maintain accuracy and compliance throughout the year. This checklist follows payroll best practices for hospitality businesses.

| Check Point | Frequency | Responsible Person |

|---|---|---|

| Verify all hours worked against rotas | Weekly | Shift Managers |

| Review time records for missed attendance entries | Weekly | Payroll Administrator |

| Check overtime hours and correct rate application | Before each payroll run | Payroll Administrator |

| Confirm tax codes have not changed | Monthly | Payroll Administrator |

| Verify National Insurance categories | Quarterly | Payroll Manager |

| Review employee classifications | Quarterly | HR Manager |

| Audit holiday pay calculations | Quarterly | Payroll Manager |

| Check tronc distributions comply with regulations | Monthly | Tronc Master |

| Update pay rates following minimum wage changes | Annually (April) | Payroll Manager |

| Review PAYE deadlines and submission compliance | Monthly | Payroll Manager |

Understanding HMRC Enforcement and the Fair Work Agency

HMRC has become increasingly active in enforcing minimum wage rules and national minimum wage compliance.

According to the government’s enforcement and compliance report, HMRC focuses particularly on sectors like hospitality where staff work irregular hours.

HMRC’s enforcement powers include:

- Carrying out inspections of payroll records

- Requiring production of records for up to six years

- Ordering repayment of arrears at current minimum wage rates

- Issuing financial penalties of up to 200% of underpayments

The Fair Work Agency Launch in April 2026

From April 2026, a new Fair Work Agency will transform how employment rights are enforced. This single enforcement body will bring together HMRC’s National Minimum Wage enforcement team with expanded powers to enforce holiday pay and statutory sick pay.

The agency can investigate workplaces proactively without waiting for worker complaints, making HMRC compliance even more critical for hospitality businesses.

UK Hospitality Employment Data

According to ONS data published in June 2025, the accommodation and food service sector shows:

- The largest decrease in payrolled employees: 124,000 between May 2024 and May 2025

- The highest annual growth in median pay: 7.5% in May 2025

- Median pay in the sector: £1,370 in May 2025

This growth in median pay likely reflects increases in the National Living Wage and efforts to attract and retain staff. These statistics highlight the importance of robust payroll processing systems that can handle rapid changes in staffing levels and pay rates.

Conclusion

Payroll errors in hospitality are not inevitable. With the right payroll software, clear processes and attention to payroll best practices, you can ensure every team member receives accurate, timely payment whilst maintaining full HMRC compliance.

The cost of payroll mistakes far exceeds the investment in proper systems and expertise. Whether you choose cloud payroll software UK solutions, outsourced payroll services or a combination of both, take action before small errors become expensive problems.

With HMRC enforcement activity increasing, the Fair Work Agency launching in April 2026 and the government publicly naming non-compliant employers, there has never been a more important time to address payroll challenges properly. Strong payroll processing systems, accurate payroll records and meeting PAYE deadlines are fundamental to your relationship with your team. Staff who trust they will be paid correctly and on time are more satisfied, more loyal and more productive in this competitive hospitality industry.

Frequently Asked Questions

How often should hospitality businesses run payroll processing?

Most hospitality businesses pay staff weekly or monthly. Weekly payments suit hourly workers with variable hours, whilst monthly payments work better for salaried managers.

What payroll records must hospitality businesses keep for HMRC compliance?

HMRC requires employers to keep payroll records for at least three years, including employee details, pay information, tax codes, leave records and tronc distributions.

How do I calculate holiday pay for zero-hours workers to ensure national minimum wage compliance?

Calculate the worker’s average weekly pay over the previous 52 weeks where they received pay, excluding unpaid weeks. Include overtime and tronc payroll payments.

What should I do if I discover payroll errors?

Act immediately. Calculate the correct amount, pay any shortfall as soon as possible and communicate openly with the affected employee to maintain trust.

What are the benefits of using cloud payroll software UK solutions?

Cloud payroll software UK systems provide real-time access from any location, automatic updates for tax changes, integration with time-tracking and simplified management of multi-site operations.

Should I consider payroll outsourcing for my restaurant or hotel?

Outsourced payroll services work well for businesses lacking in-house expertise or those wanting to focus resources on customer service. Professional providers handle all compliance hospitality requirements and PAYE deadlines.

What are the National Minimum Wage rates from April 2026?

From 1 April 2026, minimum wage rules require rates of £12.71 per hour for ages 21 and over, £10.85 per hour for ages 18 to 20 and £8.00 per hour for under 18s and apprentices.

Parul is a content specialist with expertise in accounting and bookkeeping. Her writing covers a wide range of accounting topics such as payroll, financial reporting and more. Her content is well-researched and she has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.