Cashless Kingdom: The Rise of Fintech in Britain’s Financial Ecosystem

Financial Technology (FinTech) businesses have snowballed in the UK recently, dramatically altering the country’s financial environment. By using cutting-edge technology, these firms have shifted the financial industry, changing how customers engage with financial services.

A cultural change towards digital finance has been fostered by the growth of FinTech, which features mobile banking solutions and blockchain-driven innovations. This rapid growth signifies a significant change in the UK’s economic environment, strengthening the country’s stance as an international frontrunner in capitalising on FinTech.

In this digital finance age, let’s look at how FinTech has become prominent in Britain’s financial ecosystems!

The Components of a Well-Functioning FinTech Ecosystem

The FinTech ecosystem in the UK is robust due to the numerous interconnected components. A strong digital infrastructure is the backbone of cutting-edge financial technology essential to success.

Notably, the regulatory structure is designed to foster innovation rather than hinder it. The UK has actively cultivated a culture favourable to expanding financial technology by adopting regulations encouraging entrepreneurship.

By collaborating, industry players can share ideas to fuel the sector’s growth. The UK also has an advantage in digital financial solutions because of its tech-savvy customer base. With the right combination of factors, the UK has the potential to become a world leader in FinTech.

Here, innovative technology, forward-thinking regulations, and enthusiastic consumers unite to form a vibrant ecosystem!

Introducing the UK FinTech Sector

Time has changed the way FinTech is defined in the UK. The term “FinTech” encompasses a wide range of firms, not only startups; it also includes well-established financial services firms. In recent years, FinTech firms have aimed to revolutionise banking, payment, and more by using technology.

The FinTech sector in the UK is remarkable for its ability to quickly adapt to new technology, which helps it maintain its position as a driving force in the financial industry. The potential to quickly adjust to new scenarios allows FinTech companies to lead the way in adopting cutting-edge technologies like data analytics, blockchain, and AI.

Through the proactive integration of cutting-edge innovations, the industry can fulfil the present and future requirements of the market. The UK is poised to become a world leader in FinTech due to its flexibility, allowing it to steer its future with unmatched resilience!

FinTech Investment and Consumer Adoption

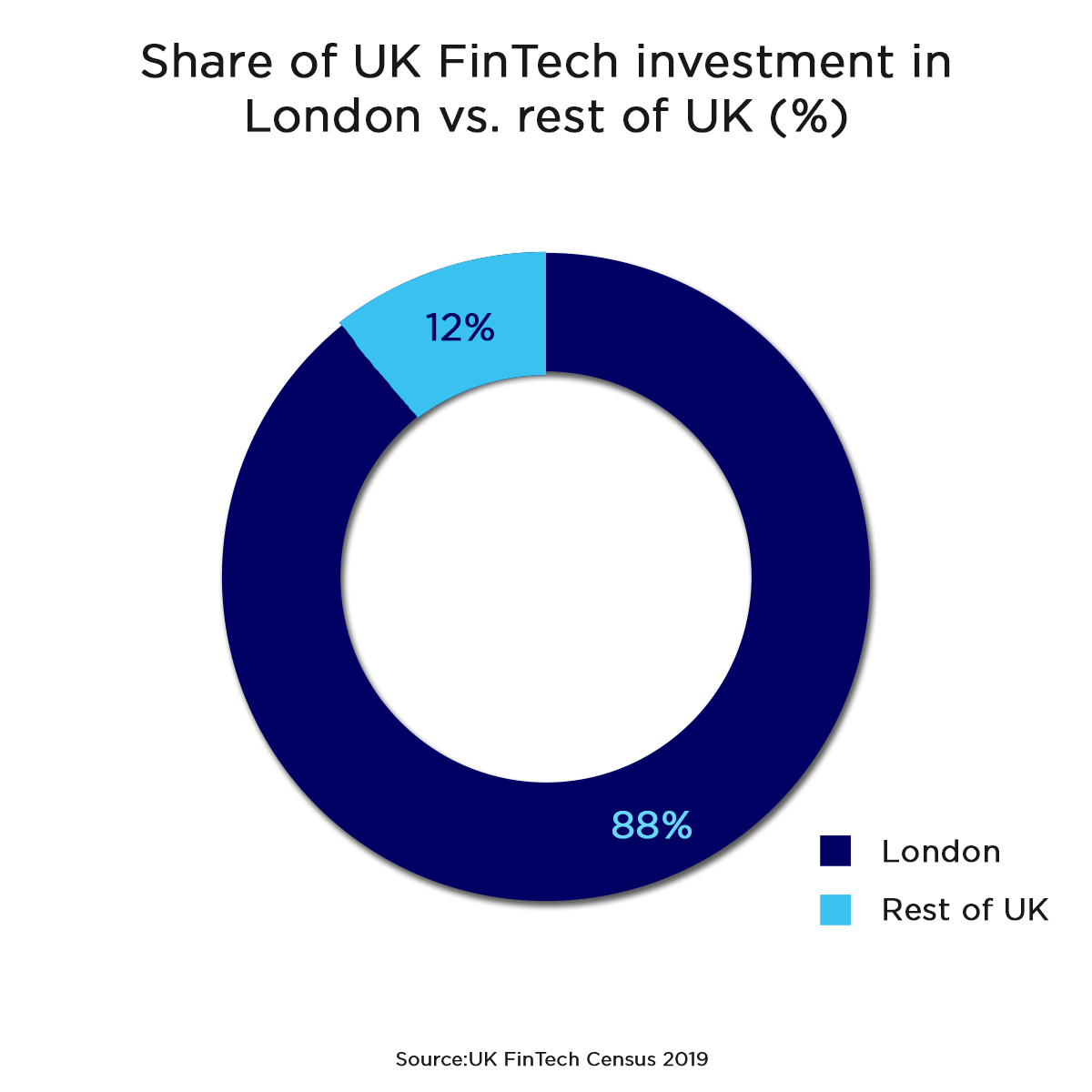

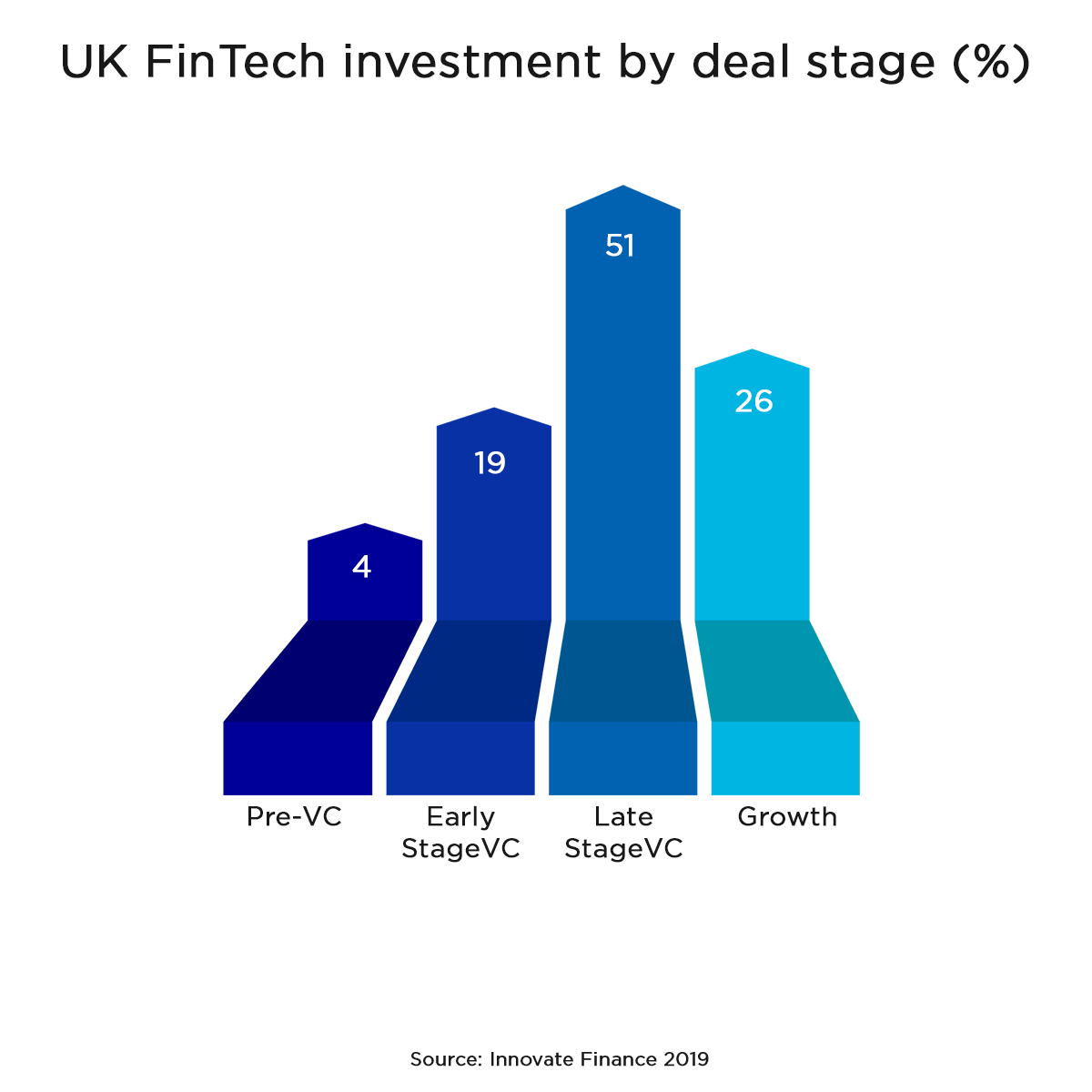

From a geographic perspective, 88% of all financing in 2019 was received by FinTechs located in London. On the other hand, Northern England and other non-London regions did quite well in fundraising.

Non-London FinTech hubs will likely see a rise in their investment share in the coming years due to the ongoing emphasis on national and regional connections. Established FinTech companies also seek to expand their operations outside London; Startling Bank is a prime example of this trend.

The flood of substantial funding into FinTech firms indicates strong trust in the industry’s potential to have a revolutionary influence. FinTech is seen as a critical player in shaping the future of finance.

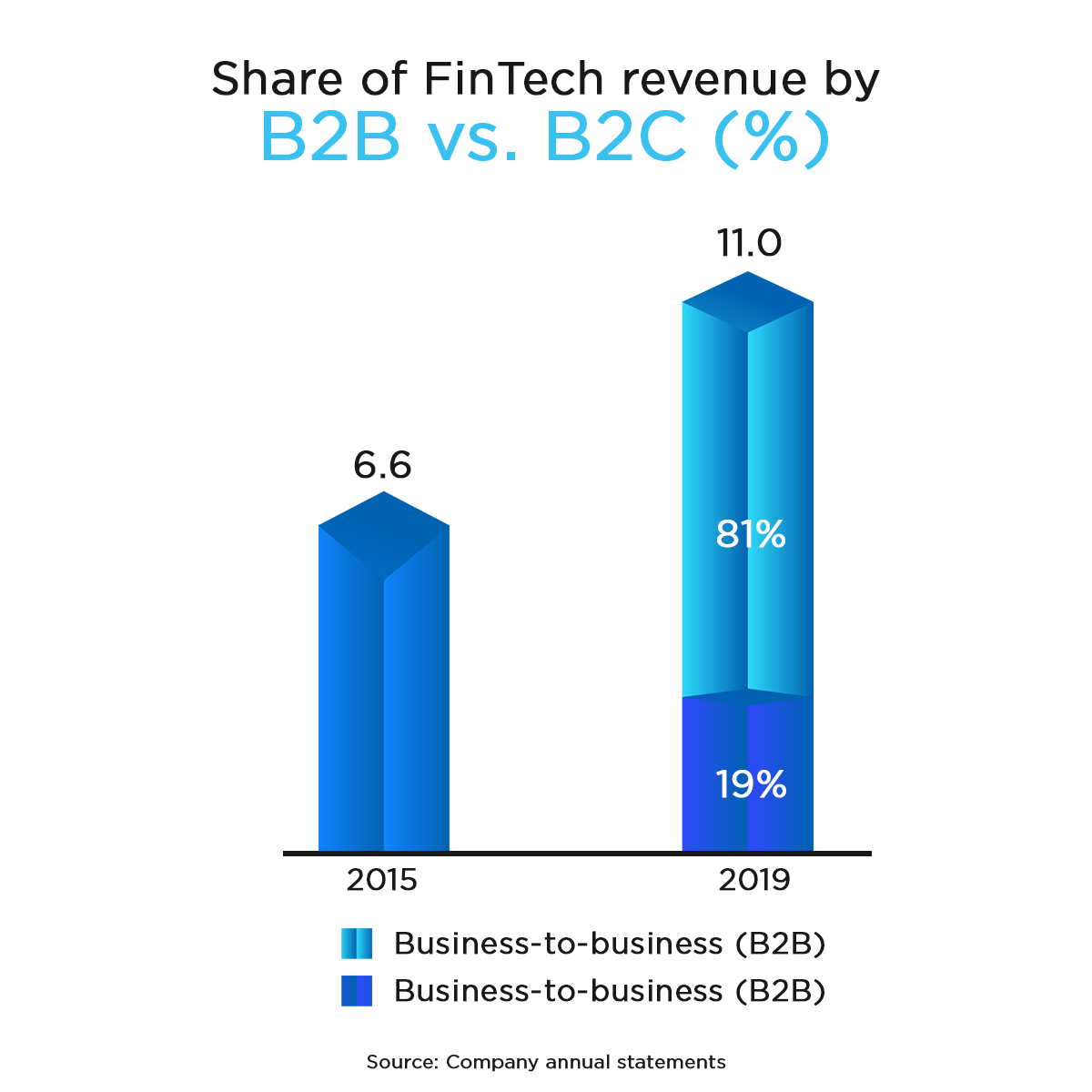

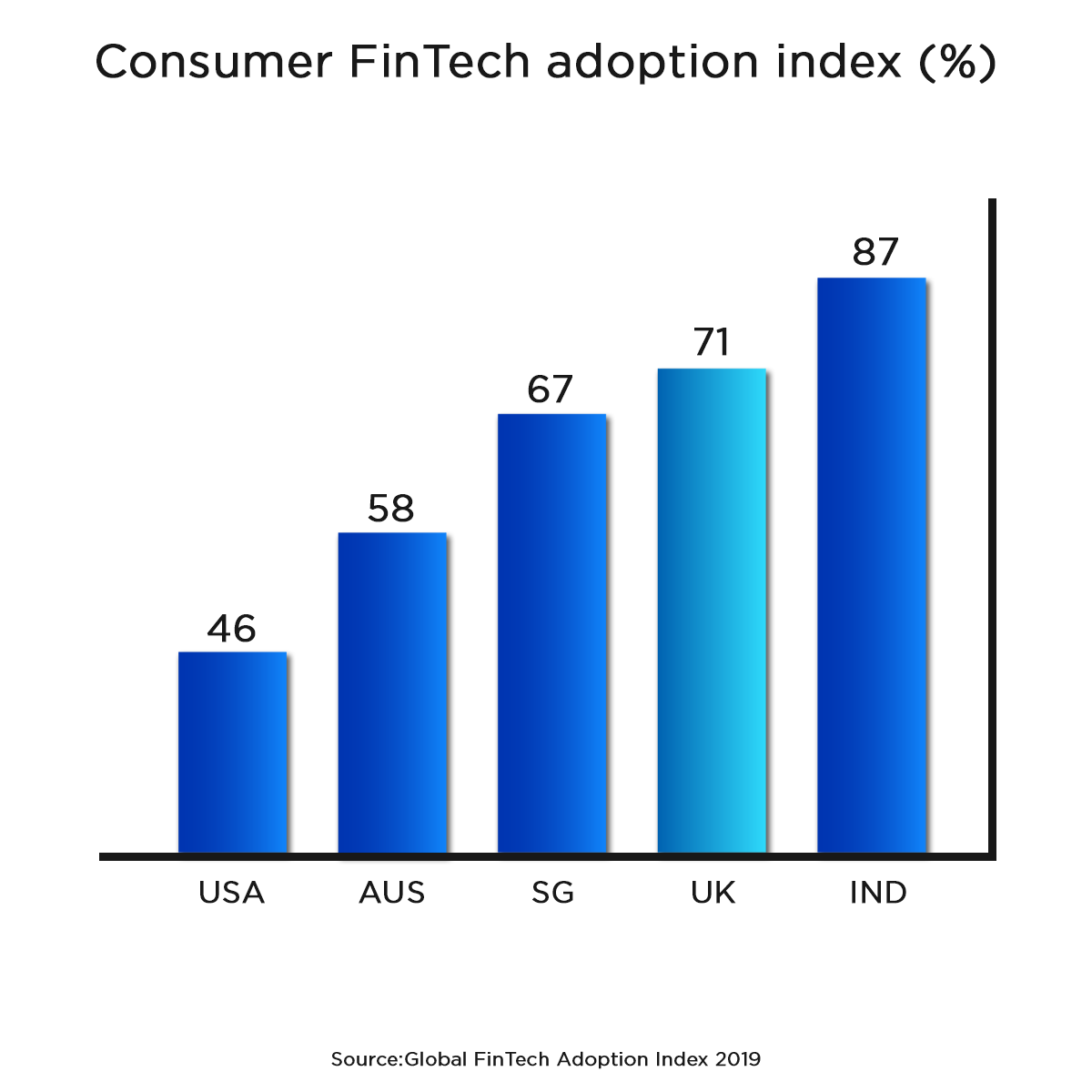

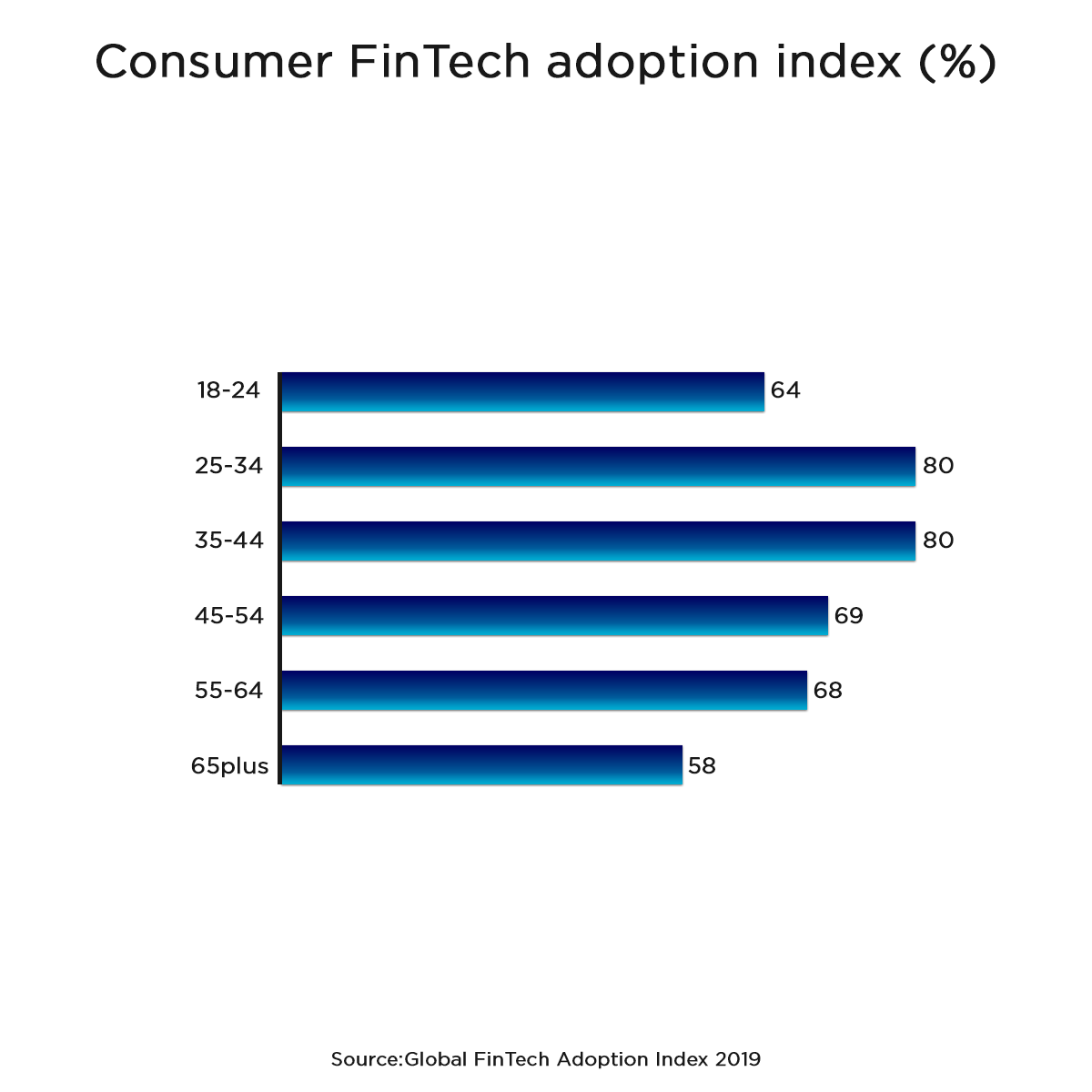

In addition, there was a considerable increase from the 14% recorded in 2015 to the 71% adoption level of FinTech among the digitally engaged population in the UK in 2019. A paradigm change in consumer financial behaviour is mirrored in the increasing adoption of these technologies.

This trend demonstrated how people are becoming more reliant on FinTech to meet their various financial demands as they incorporate these solutions into their everyday lives.

With rising investment and widespread customer acceptance, FinTech has firmly established itself as an essential player in the financial services industry, changing things significantly from traditional ways!

Areas of Innovation by Subsector

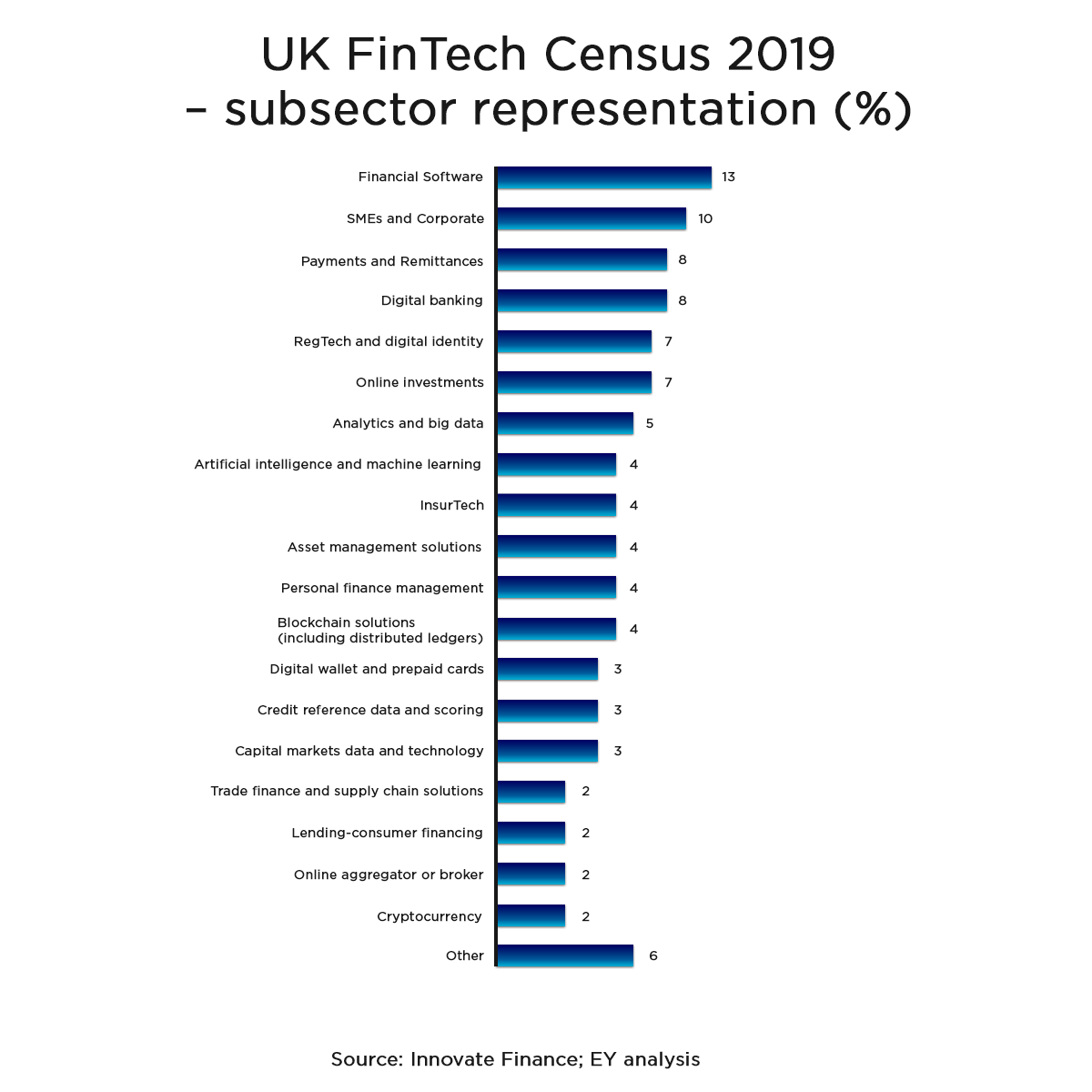

Innovation in the UK’s FinTech industry spans several different subsectors. Adopting cutting-edge technology, the landscape explores blockchain, which transforms the safety of monetary transactions.

Data analytics and personalised financial services are seeing significant improvements due to AI. Streamlined solutions make their way to payment systems as part of this holistic approach. Technology is also revolutionising investing methods by improving risk assessment and portfolio management.

It will be fascinating to witness how specific subsectors, including online aggregators, personal financial management, and credit data scoring, especially if basic enables like open banking infrastructure continue to emerge.

Let’s take a look at some of the revolution:

Digital Wallet Revolution

The emergence of digital wallets is a significant shift in the UK’s financial sector. Using these digital vaults for passwords and cards has improved security while streamlining the payment process. A radical change from conventional payment systems, digital wallets are quickly becoming consumers’ preferred payment mode.

Mobile Payments and Contactless Transactions

Consumer habits have undergone an extensive shift due to the rise of contactless transactions and mobile payments. The widespread adoption of smartphones has led to expanding payment possibilities beyond conventional methods. Undoubtedly, mobile payments & contactless transactions have quickly become prevalent, providing users with unmatched ease in financial transactions.

Peer-to-Peer Lending and Crowdfunding

We also look at the revolutionary rise of crowdfunding and peer-to-peer lending. Now more than ever, a network of investors can provide direct money to individuals and businesses through digital platforms. A fairer financial ecosystem has been fostered by the openness of lending made possible by this decentralisation of finance.

In closing, the UK is well on its way to becoming a cashless country due to FinTech. An ever-changing financial ecosystem is shown as the meeting point of innovation, investment, and consumer acceptance. The UK is a shining example of how technology is reshaping the financial sector as we see the rise of digital wallets, mobile payments, and peer-to-peer lending!