For UK businesses, choosing the right accountant is one of the most important decisions to make. The cost of accountants can vary widely but focusing only on price risks losing more through poor advice or mistakes. An accountant’s role extends far beyond preparing accounts and submitting tax returns. They are essential partners in managing your business’s financial health and future growth.

However, poor accounting practices and errors in tax filing and ineffective tax planning can quietly erode your profits and increase the hidden cost of accountants by exposing you to unnecessary costs, penalties and missed opportunities.

This article highlights 10 key warning signs that your accountant may be costing you more than you realise, helping you identify issues early and take action to protect your business.

Why having the right Accountant’s matters?

A good accountant isn’t just someone who handles your tax returns. They should be a trusted financial advisor who provides strategic support across multiple areas:

- Tax planning and optimisation to minimise your tax liability legally.

- Compliance management ensuring all deadlines are met and regulations followed.

- Financial advice designed to your business growth stage and industry.

- Strategic support helping you make informed decisions about investments, expansion and cash flow.

- Risk management identifying potential issues before they become problems

The risks of relying on unqualified or negligent accountants are significant. Ineffective tax planning can result in overpayment of taxes. Accountant errors in tax filing can lead to HMRC investigations.

Poor financial advice results in cash flow crises or missed growth opportunities. In simple terms, your accountant’s skills directly affect your financial success and growth.

Understanding these risks helps you recognise when your accountant isn’t supporting your business properly.

Key factors to check if your Accountant is costing your business money

It is vital for business owners to know when their accountant is not doing their job well. An accountant who is simply doing the bare minimum is not a good deal, no matter how low their initial price is. Mistakes and missed opportunities caused by poor accounting can quickly become costly for your business.

1. Lack of proactive financial advice

A truly valuable accountant doesn’t just respond to your queries they anticipate your needs and provide strategic guidance before you even ask. They should regularly suggest tax-saving strategies, cash flow improvements and growth opportunities tailored to your business.

Signs to watch for:

- No regular financial reviews or strategic planning sessions.

- Your accountant only contacts you during tax season.

- They never suggest tax reliefs, allowances or planning strategies you might benefit from.

- No recommendations for improving profitability or managing cash flow.

- You feel like you’re the one driving all financial decisions without expert input.

The impact:

Without proactive advice, you miss out on chances to lower your tax bills and improve business performance. A reactive accountant increases the hidden cost of accountants by failing to reduce your tax payments and optimise finances.

A proactive accountant keeps up with tax law changes and reviews your financials regularly to spot trends and suggest improvements if yours doesn’t, you’re not getting value for money.

2. Missed deadlines and filing errors

Submitting your returns on time and accurately to HMRC and Companies House is a basic but vital part of accounting. Missed deadlines lead to automatic fines and errors can cause investigations and further penalties.

Signs to watch for:

- Repeatedly late filings of Corporation Tax, Self Assessment, VAT or annual accounts.

- Errors in submitted documents that need fixing.

- No reminders for upcoming deadlines or check-ins for review.

- Penalties issued due to late or incorrect submissions.

The impact:

Penalties accumulate quickly Company Tax returns incur an immediate £100 fine, rising further if late payment continues. Mistakes damage your standing with HMRC leading to more checks and stress. Time spent on correcting errors is the time taken away from growing your business.

3. Poor communication and responsiveness

Your accountant should be easy to contact, clear in explanations and keep you well informed about your finances and deadlines.

Signs to watch for:

- Long delays before answering urgent queries.

- Explanations full of jargon or too vague.

- No regular updates or check-ins on your accounts.

- Difficult to reach by phone or email.

- Feeling like you’re bothering them to get information.

- Constantly handed from one team member to another with no consistent contact.

The impact:

Poor communication leaves you in the dark about important financial opportunities or deadlines. You risk missing dividend planning, pension contributions and capital allowance claims time-sensitive tasks that could save you on tax. An accountant who doesn’t communicate well may also be disorganised or not prioritising your account.

4. Unclear or unexpected fees

You should always know exactly what services you are paying for and any extra charges.

Signs to watch for:

- Invoices that lack detail on services provided.

- Surprise bills for tasks you thought were included.

- Vague answers when you ask about fees.

- Frequent additional charges without clear explanation.

- Fees that seem too high compared to the work done.

- No formal engagement letter outlining costs and services.

The impact:

Unexpected fees reduce your profits and increase the true cost of accountants. A lack of transparency in billing may indicate poor business practices and should be a major concern when choosing or staying with an accountant.

5. Failure to understand your business needs

No business is alike, so advice should not be generic. Your accountant should take time to understand your unique circumstances and provide recommendations accordingly.

Signs to watch for:

- One-size-fits-all advice that ignores your industry’s specifics.

- No understanding of industry-specific tax reliefs or regulations.

- Generic recommendations with no customisation.

- Failure to ask about your business plans or model.

- Advice that contradicts your sector’s common practices.

- No discussion of your goals or plans for growth.

The impact:

Without proper advice, you’re likely might miss on valuable tax reliefs like R&D credits or investment allowances relevant to your sector. Generic advice can lead to costly mistakes or missed optimisation opportunities that small businesses can’t afford.

6. Inadequate tax planning

Managing tax efficiently means planning throughout the year, not just at tax return time.

Signs to watch for:

- No discussions on tax-efficient methods until very late.

- Failure to highlight reliefs, allowances or exemptions available to you.

- No long-term tax strategy aligned to business growth.

- Only reactive help during tax season.

- Missed chances to time income or expenses for tax savings.

- No advice about pension contributions, dividends or capital allowances.

The impact:

Poor tax planning often results in you paying more tax than necessary. Missing deadlines for pension contributions or capital purchases can cost your business thousands. Proactive tax planning could save you money.

7. Relying on an unqualified accountant

Only accountants with recognised qualifications such as ACA, ACCA or CIMA are trained to handle complex UK tax and accounting rules professionally.

Signs to watch for:

- Inability to prove qualifications.

- No membership in professional accounting bodies.

- No evidence of professional development or training.

- Cannot provide client references or testimonials.

- No professional indemnity insurance.

The impact:

Unqualified accountants are more likely to make errors, miss opportunities, and fail compliance checks. You also have little legal protection if they mess up. Trying to save money with an unqualified accountant usually backfires and costs you more.

8. Resistance to modern technology

Cloud accounting software like Xero or QuickBooks is now the industry standard for accuracy and efficiency.

Signs to watch for:

- Insisting on manual or paper-based systems.

- No online access to your financial data.

- Unaware of Making Tax Digital (MTD) requirements.

- Refusal to use digital tools or online portals.

- Asking you to send physical documents rather than electronic files.

The impact:

Manual, outdated methods increase the risk of errors and delay access to timely financial information. Without digital accounting, you may also struggle to meet HMRC’s MTD regulations and miss out on efficiency gains.

9. Failing to identify risks and opportunities

Your accountant should do more than record finances they should analyse and advise.

Signs to watch for:

- No regular financial insight reports or performance reviews.

- Failing to flag cash flow problems or financial risks.

- No advice on government grants, tax credits or support schemes.

- No comparison of your performance to industry benchmarks.

- Reactive, rather than predictive, in their approach.

The impact:

Without these insights, you are running your business without a clear view of your money. This can lead to running out of cash or missing chances to grow and get support.

10. Resistance to change or switching

Professional accountants welcome feedback and will openly discuss if a different provider suits your business better.

Signs to watch for:

- Defensiveness when you raise concerns.

- Refusing to fix issues or improve service.

- Hiding financial records or making access difficult.

- Blocking attempts to switch accountants.

- Lack of transparency about handover.

- Forcing clients into inflexible long-term contracts.

The impact:

An accountant who doesn’t want to change is probably putting their own needs before yours. Staying with a poor accountant because it feels hard to switch can cost your business both money and peace of mind. Changing accountants in the UK is easier and less risky than you might think if you follow the right steps.

How to recognise these signs?

Self-assessing your current accounting relationship is the first step to ensuring you get value for money. Use this checklist to evaluate whether your accountant meets professional standards and provides the support your business deserves.

Assessment Checklist

| Question to ask yourself | Yes/No | What this means? |

|---|---|---|

| Are they planning ahead? | Do they offer tax planning ideas throughout the year, not just at year-end? | |

| Are they easy to contact? | Do they answer important questions within a day? | |

| Are the fees clear? | Have you received any surprise bills or unexpected charges in the last 12 months? | |

| Are they using current tools? | Do they use or recommend up-to-date cloud accounting software? | |

| Do they help you save money? | Have they helped you find at least one new tax saving in the last 12 months? | |

| Are they verified? | Have you checked their official qualifications (e.g., ACCA, ICAEW)? |

If you find three or more warning signs, it’s time to check if your accountant is really helping your business. Most accountant mistakes happen repeatedly, not just once. Spotting problems early can save you money and stress.

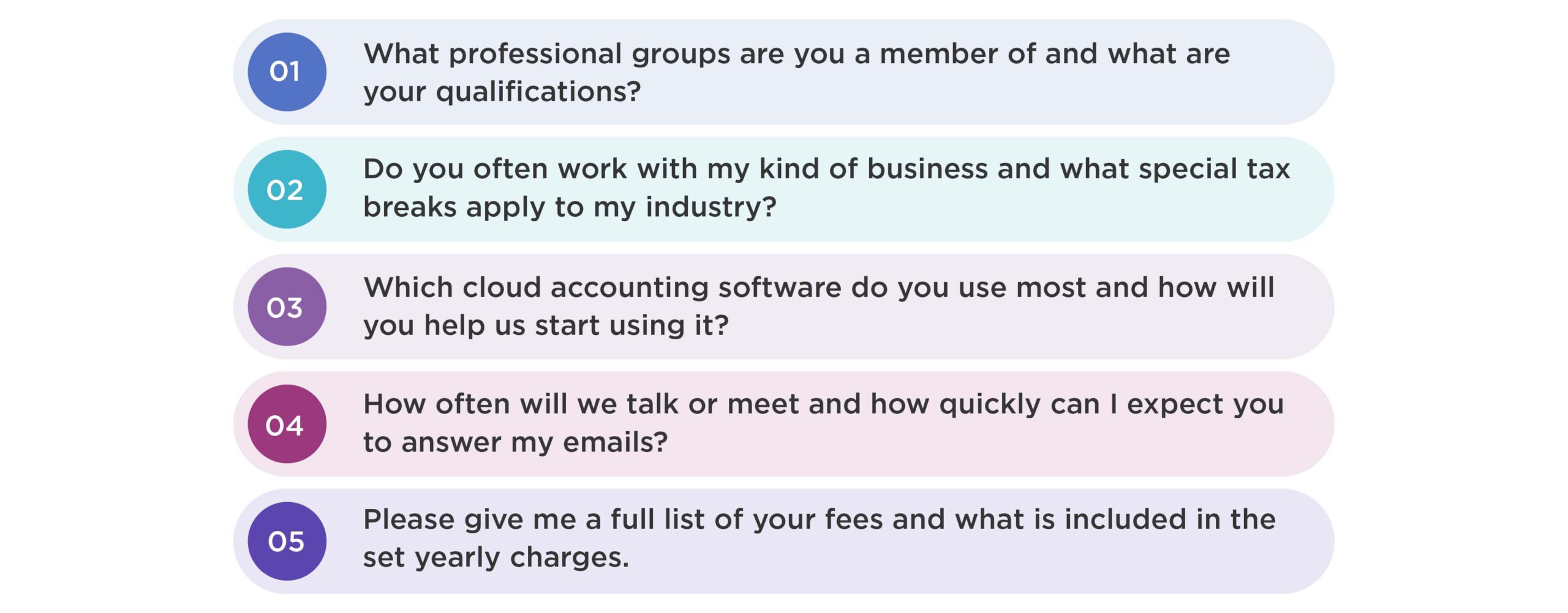

Questions to ask before hiring a new Accountant

Before you risk another year of hidden costs of bad accounting, use these key questions to check any new accountant. This will help you avoid hiring an unqualified accountant or one who just won’t be helpful.

- “What professional groups are you a member of and what are your qualifications?” (Make sure you check their membership.)

- “Do you often work with my kind of business and what special tax breaks apply to my industry?” (This tests if they know your business well.)

- “Which cloud accounting software do you use most and how will you help us start using it?” (Shows if they are using modern, quick technology.)

- “How often will we talk or meet and how quickly can I expect you to answer my emails?” (Sets clear rules for how you will talk to each other.)

- “Please give me a full list of your fees and what is included in the set yearly charge.” (Makes sure the fee is clear and stops any surprise costs.)

Steps for a smooth change

Switching accountants in the UK is very common and can be done easily if you follow a few simple steps. This makes sure you don’t lose any data or break any rules.

- Choose the new accountant first: Select a qualified accountant using the criteria and questions discussed earlier before informing your current accountant.

- Tell the old accountant: Write a formal letter or email to your current accountant saying you are ending their service. Tell them your new firm will be in touch to get your files.

- The handover process: Your new accountant will contact the old one to request for ‘professional clearance’ and the transfer of all your business records. This is a normal process that must be completed properly and quickly.

- Transfer your data: Ensure that all digital files, like cloud accounting data, as well as tax records and official documents, are safely moved to your new accountant.

- Best time to move: The easiest time to change accountants is just after your financial year ends but before work begins on the new year’s accounts. This avoids confusion and double billing.

Conclusion

The true cost of accountants goes beyond their fees. Your most expensive accountant isn’t the one who charges the most it’s the one whose mistakes and missed opportunities lose you money. Spotting the warning signs of poor financial advice early protects your profits.

By being proactive, expecting good service and choosing a fully qualified and involved accountant, you turn accounting from a chore into a tool for growth. Don’t let your accountant become a hidden cost.

Review their work today and talk to a trusted professional if you notice any of the ten red flags about UK business accountant fees in 2025 or service quality.

Frequently Asked Questions (FAQs)

How can I tell if my accountant is costing my business money?

What are common mistakes accountants make that hurt small businesses?

How do I spot an unqualified accountant?

When is it time to switch accountants?

What questions should I ask before hiring a new accountant?

How can poor accounting affect business growth?

Parul is a content specialist with expertise in accounting and bookkeeping. Her writing covers a wide range of accounting topics such as payroll, financial reporting and more. Her content is well-researched and she has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.