Post Super Deduction Regime

End of the 130% Super Deduction

The 130% ‘super deduction’ Capital Allowances relief came to an end on 31 March 2023. This may affect the tax relief available on expenditures incurred by companies.

The Spring Budget 2023 also introduced ‘full expensing’, effective from 1 April 2023, allowing companies to deduct the full cost of qualifying plant and machinery from taxable profits in the year of purchase.

Timing and Transitional Rules

There are complex rules around the timing of capital expenditure. Together with the transitional rules when the super-deduction ends, these can affect the availability of the full 130% super-deduction.

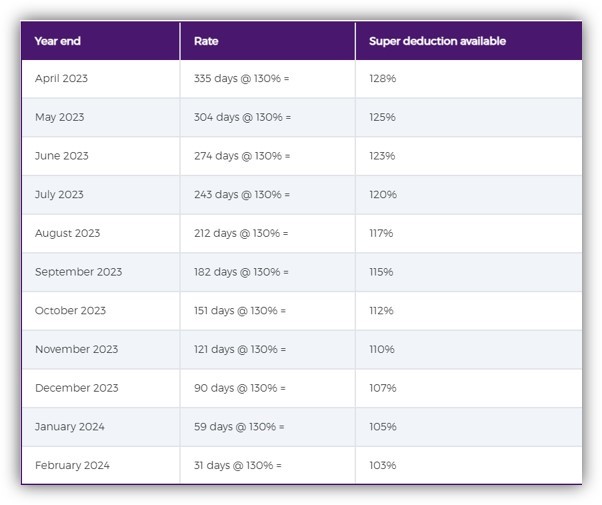

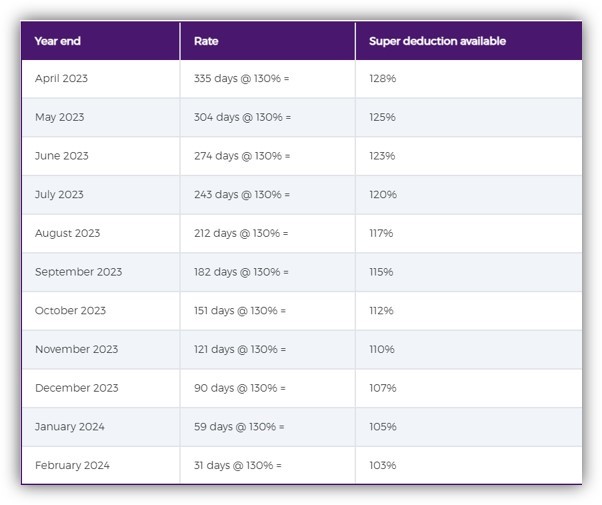

If expenditure falls in an accounting period that straddles the end of the qualifying period (i.e., 1 April 2023), the super-deduction rate will be time-apportioned.

Impact on Companies with Different Year Ends

-

March year-end companies: The super-deduction will be available in full for qualifying expenditure for the accounting year ending 31 March 2023.

-

Companies with accounting periods ending after 1 April 2023: The available super-deduction will reduce proportionally.

Example: A company with a 31 March 2023 year-end can claim the full 130% deduction, while a company with a 30 April 2023 year-end will only be eligible for a reduced proportionate deduction.