INSIDE

THE ISSUE

Imagine an accountant working tirelessly to serve clients but drowning in the complexity of accounting costs.

Businesses in today's fast-paced environment often face a crossroads when charting their future financial course.

As we live in an increasingly digital and fast-paced world, businesses continually look for new methods to boost productivity and morale.

The training department has worked towards excelling in making use of its resources to train 20 people on Nomi BK software.

Outbooks Pricing & Proposal Tools Are the Way to Financial Transformation

In the heart of the accounting world, where numbers often dominate, a profound transformation occurs, driven by two extra ordinaries - Outbooks Pricing Calculator and Proposal Tool. These tools aren't just changing the accounting game and lives.

Imagine an accountant working tirelessly to serve clients but drowning in the complexity of accounting costs. Then, the Pricing Calculator steps in, shedding light on the financial maze and bringing clarity and trust to every interaction. The burden of hidden fees and financial uncertainty is lifted, and this accountant can now empower clients with informed decisions, setting them on a path to financial stability.

Picture a business striving to win over clients in a competitive landscape. Crafting proposals used to be a daunting task, a struggle against time and errors. But with the Proposal Tool, the game changes. This business can create proposals that captivate hearts and close deals in minutes. Efficiency soars, revenue follows, and dreams are realised.

These tools aren't just numbers; they're the essence of transformation. They're about trust, efficiency, and client-centricity. They're about dreams fulfilled, and lives changed. Outbooks Pricing Calculator and Proposal Tool are more than tools; they're the catalysts of a brighter, more empowered future in the accounting world.

The Pricing Calculator and Proposal Tool are two potent tools provided by Outbooks, a pioneer in financial services, that have the potential to revolutionise the way businesses handle their money. This in-depth guide will explore how to use these tools to their fullest potential.

Know Why the Transparent Pricing Matters

Effective financial management begins with transparency in pricing. It ensures that businesses understand precisely what they are paying for, avoiding the pitfalls of hidden fees or unexpected charges. Transparent pricing builds trust between service providers and clients, fostering better budgeting and strategic planning.

Outbooks Pricing Calculators are invaluable tools that empower businesses to estimate costs for various financial services. These calculators consider multiple factors, such as the scope of services required, the complexity of financial transactions, and the unique needs of your business. By inputting these parameters, you can obtain precise estimates of expenses related to accounting services, payroll, tax filing, and more.

The Smart Way to Get the Right Price for Your Brand

Must Use Price Calculator

You may use a variety of online pricing calculators to help you choose the appropriate cost for your good or service.

Ask for Consumer Input

Find out how much your clients will spend on your goods or services. You may want to adjust your pricing approach considering this criticism.

Employ a Pricing Strategy Manual

Several pricing strategy manuals may assist you in creating a pricing plan that is appropriate for your company.

Importance of Accounting Pricing Calculators

Pricing calculators provide several benefits: transparency, informed decision-making, improved budgeting, time efficiency, customisation, increased communication, resource optimisation, comparative analysis, financial confidence, and correct planning. These advantages enable accountants and organisations to manage their finances better and make informed financial decisions.

1. Better Clarity

Pricing calculators provide a clear picture of the expenses associated with various services. Users obtain clarity on what they pay for, ensuring no hidden fees or unexpected charges later.

2. Enhanced Informed Decisions

Individuals and organisations may make well-informed judgements if they get precise cost estimates using price calculators. This allows people to select services appropriate for their financial situation and individual demands, avoiding overpaying or settling for inferior solutions.

3. Budgeting

Pricing calculators are essential for good budgeting. These tools help users manage their budgets by offering precise, straightforward expense forecasts. Individuals and corporations may deploy resources sensibly and avoid financial shocks if they have a realistic awareness of anticipated expenditures.

4. Improved Efficiency

Pricing calculators' efficiency stems from their capacity to deliver fast estimations. Users may receive cost estimations quickly rather than engaging in protracted negotiations or waiting for quotations. This time-saving feature enables both service providers and clients to expedite decision-making.

5. Easy Customisation

Users can customise price calculator inputs to fit their circumstances. Whether it's the extent of services, frequency, or special requirements, the calculator tailors estimates to meet individual or corporate demands perfectly, guaranteeing accurate cost estimations.

6. Communication Clarity

Pricing calculators encourage open and transparent communication between clients and service providers. Discussions become more effective when everyone has common knowledge of the expenses. Pricing misunderstandings are reduced, resulting in a more positive working relationship.

7. Comparative Analysis

Pricing calculators help customers to evaluate various service alternatives. You can quickly examine the costs and advantages of each option by entering different scenarios, making it easy to choose the best solution for their needs.

8. Financial Confidence

Accurate cost estimation will help you to boost your financial decision-making confidence. You can get accuracy in knowing the decisions are well-informed and aligned with their financial limits.

9. Accurate Planning

Pricing calculators enable consumers to plan their financial obligations precisely. This eliminates underestimating or overestimating costs, allowing for more efficient financial planning and avoiding financial setbacks.

10. Financial Confidence

Accurate cost estimates boost financial decision-making confidence. Users may proceed confidently, knowing their decisions are well-informed and aligned with their financial limits.

Smart Budgeting & Accurate Pricing Made Easy with Outbooks Pricing Calculators

Here is the list of smart Outbooks Pricing Calculator Tools for getting the correct value for your brand:

Bookkeeping Pricing Calculator

Estimate costs for professional bookkeeping services based on transaction volume, account complexity, and additional needs. Make informed decisions while avoiding surprises in pricing.

- Calculates costs for professional bookkeeping services

- Considers transaction volume, account complexity, and additional services

Payroll Pricing Calculator

Calculate expenses for outsourced payroll services by considering employee count, pay frequency, and payroll-related needs. Budget accurately and streamline payroll management.

- Estimates the cost of outsourcing payroll services

- Employee count, pay frequency, and payroll-related services are all considered.

Accounts Finalisation Pricing Calculator

Determine expenses for preparing statutory accounts and corporation tax services. Account for financial complexity and tax considerations, ensuring compliance and precise reporting.

- Determines costs for preparing statutory accounts and corporation tax services

- Reflects financial complexity, detail needed for statutory reporting, and tax considerations

Self-Assessment Pricing Calculator

Assess costs for personal tax return assistance, accounting for income sources, deductions, and complexity—plan for accurate tax filings.

- Assesses costs for assistance with personal tax return filings

- Accounts for individual financial complexity, income sources, and deductions

Accounting Package Pricing Calculator

Price comprehensive accounting packages encompassing bookkeeping, payroll, tax filing, and financial reporting services. Customise solutions and allocate resources effectively.

- Helps price comprehensive accounting service packages

- Considers bundled services like bookkeeping, payroll, tax filing, and financial reporting

How to Use the Outbooks Pricing Calculator for Accurate & Effective Pricing?

The Outbooks Pricing Calculator is simple to use:

- Go to the Calculator: These practical calculators are available on the Outbooks website. Go to the Pricing Calculator Page on the Outbooks website and click on that.

- Input Business Information: Provide information about the size of your business, the number of monthly transactions, and any particular services needed.

- Receive a quick Estimate: The calculator will create an astute estimate based on your inputs, breaking down the expenses involved.

- Compare Plans: If relevant, you can compare several price plans to find the best match for your company.

- Access Educational Content: Use Outbooks' supplementary resources to improve your grasp of bookkeeping and its importance.

Must Try the Advanced Outbooks Proposal Tool to Win More Sales and Land New Clients

In the fast-paced accounting world, making a lasting impression on clients is paramount. That's where the Outbooks Proposal Tool comes in, designed exclusively for accountants who aspire to create beautiful, compelling, and personalised accounting and bookkeeping proposals in minutes.

Why is Outbooks Proposal Tool Winning the Sales Game?

Your staff can spend hours composing just one proposal without a proposal management tool. It takes time to complete each proposal, from obtaining resources to awaiting information to combining everything. After the proposal is completed, the hours begin again for the following proposal.

A proposal tool of Outbooks can be used to expedite and improve the proposal process. Your sales team may work remotely with colleagues and clients, share information across several platforms, and prepare proposals using templates. This speeds up creating and delivering personalised offers and improves your company’s productivity.

Features that Set Us Apart

Outbooks Proposal Tool comes with an advanced features set that are as follows:

- Professionalism Unleashed

With Outbooks Proposal Tool, you can harness the power of pre-built templates and adjustable formatting, giving your proposals a polished, professional edge that leaves a lasting mark on your clients. - E-Signature Mastery

Streamline the approval process with seamless e-signature capabilities. No more hassle with paperwork or delays; your clients can sign off on proposals effortlessly. - Real-Time Insights

Gain a competitive edge with a real-time view of your proposals. Know when clients have viewed your proposals and get insights to tailor your follow-ups effectively. - Data Integration

Incorporate data into your proposals like never before. No more hours crunching numbers; our tool seamlessly integrates data, saving you time and ensuring accuracy. - Stand Out in Style

Stand head and shoulders above your competitors with proposals that are not just documents but captivating experiences. Impress your prospects and increase your chances of closing deals faster.

Benefits of Using Outbooks Proposal Tool

Time-Saving:

Crafting proposals from scratch can be time-consuming. Outbooks Proposal Tool streamlines the process by offering templates and customisation options, allowing you to create compelling proposals quickly. This time-saving feature is precious for businesses with tight deadlines.

Customisation:

Not all proposals are the same, and clients have different needs. The tool allows easy customisation, enabling you to tailor each proposal to each client's requirements and preferences. This personalised approach can increase your chances of success.

Error Reduction:

One of the most significant advantages of using the Outbooks Proposal Tool is minimising errors in your proposals. Typos, formatting issues, and other mistakes can harm your professional image. The tool ensures your documents are error-free, enhancing your professionalism.

Tracking and Analytics:

The Outbooks Proposal Tool often provides tracking and analytics features that allow you to monitor when your proposal has been viewed and how much time clients have spent on each section. This data can help you gauge client interest and tailor your follow-up accordingly.

Collaboration:

If you work in a team, the Outbooks Proposal Tool facilitates collaboration. Multiple team members can contribute to and review proposals, ensuring they meet the highest quality standards.

Enhanced Reporting:

You can generate detailed reports on the performance of your proposals, helping you assess which proposals are more successful and which areas may need improvement. This data-driven approach allows for continuous refinement of your proposal strategy.

Streamlined Workflow:

The Outbooks Proposal Tool simplifies proposal creation, streamlining workflow and reducing administrative burdens. This efficiency allows your team to focus on higher-value tasks.

Embark on a Journey of Financial Transformation with Outbooks

Outbooks Pricing Calculators and Proposal Tools are not just tools; they are catalysts for financial success and professional excellence.

By effectively utilising these tools, your business can achieve maximum benefits, from accurate cost estimation and informed decision-making to streamlined proposal creation and enhanced client interactions.

In a landscape where every moment counts, Outbooks Pricing Calculators and Proposal Tools empower you to make the most of your time, resources, and potential. It's not just about numbers; it's about the impact you make, the trust you build, and the financial excellence you achieve.

So, whether you're an accountant striving for precision or a business aiming for growth, these tools are your companions on the journey to success. Utilise them fully, and watch as your financial endeavours reach new heights.

Outbooks is here to redefine the game; are you ready to play?

Amit Agarwal

Managing Director, UK

OUTBOOKS

Profitability Vs. Growth- Striking the Right Balance in Accounting

Businesses in today's fast-paced environment often face a crossroads when charting their future financial course. Finding the point of balance between profitability and expansion is challenging but vital for every business. A company's profitability reflects its success in raising capital from investors, controlling costs, and turning a profit.

When a business expands its operations, enters new markets, and gains market share, this is seen as growth. However, if you give less attention to one, it might harm the other. Finding a happy medium between profitability and growth is one of the biggest challenges firms face today. However, identifying the sweet spot is critical for success and value creation in the long run.

Beyond the Numbers: The Essence of Profitability in Business

Profitability is the driving force behind every successful business. A firm's profitability is directly proportional to how well it can maximise its available resources. It defines the extent to which a company can profit after taking out its operating costs.

A solid competitive advantage goes to a firm that can maintain profitability regularly. These companies can endure economic crises because their foundation is strong. In addition, a prosperous business climate encourages creative risk-taking and new product development. These businesses have the means to invest in R&D and creative thinking, guaranteeing continued success.

At the same time, if a company is successful, it will have an easier time meeting all its financial commitments. It will be better equipped to repay its loans on time. Profit margin, Return on Assets or ROA, and Return on Equity or ROE are three of the most revealing indicators of a company's financial health.

The net profit margin and ROA measure how well costs are controlled and prices are established. However, the Return of Equity shows a company's proficiency at converting shareholder stock into profits.

Profitability is more than a financial indicator; it represents a company's capacity to deal with change, foster creativity, and satisfy its stakeholders. Businesses prioritising and improving their profitability ensure their longevity and help the economy.

Beyond Horizons: Unveiling the Dynamics of Business Growth

Businesses that want to expand their reach and have more impact must focus on growth. It's the fuel that helps companies grow and provides various gains that determine their future course. Gaining a larger market share increases a company's visibility and credibility. Along with this rise in popularity comes increased brand awareness, enhancing the company's standing.

The effects of growth go beyond how things seem, hitting on financial well-being. It is economically significant because it allows firms to extend their markets' income and profits. There are several forms of growth. New clients and areas are drawn in by the organic expansion made possible by innovations, new product releases, and market openings.

In contrast, inorganic growth strategies, such as mergers and acquisitions, speed up market expansion by focusing on preexisting resources and experience. A company's ability to implement expansion plans can be assessed by analysing key growth measures such as revenue growth and client acquisition rates. Both the customer acquisition rate and the revenue growth show the attractiveness of a firm to potential new customers as it grows.

Navigating the Crossroads: Balancing Profit and Growth Dynamics

Growth and profitability are mutually beneficial, yet they can conflict at times. Aggressive growth methods can need significant investments, reducing short-term profits but increasing them in the long run.

On the other hand, if profits are prioritised above growth and innovation, long-term expansion can be stunned. Finding the sweet spot involves knowing the company's finances, the market, and long-term objectives.

Difficulties in Striking a Balance Between Profit and Growth

Allocation of Resources: It might be challenging to decide how much to invest in ongoing operations against new growth opportunities. To ensure long-term development without sacrificing profits, businesses must carefully consider when and how much to spend

Management of Risk: Increased competition, regulatory hurdles, and supply chain delays are just some of the hazards a rapidly expanding business can face. It is essential to strike a balance between expansion and fear of risk.

Prospects of Capital Gains: Some investors put a premium on quick gains, while others favour steady growth over the long haul. Businesses must do an excellent job of managing these expectations.

Cost Reduction: Excessive expansion is expensive for several reasons. Keeping costs in check during growth is crucial for maintaining stable profits.

Fine-Tuning the Profit-Growth Equation: Implementing Winning Strategies

Profitability Analysis by Segments

Conduct a separate evaluation on several market subsets or product lines of businesses. It frees up resources to prioritise profit maximisation in established markets while funding promising ones.

For instance, an accounting company can divide its offerings into speciality areas. It can prioritise maximising profits in its more traditional tax and auditing services while expanding into data analytics and cybersecurity advice to better serve its customers' changing demands in the digital era.

Implementing Steady Expansion

Businesses might choose gradual over quick expansion. Hence, they can calculate the ROI for each new expansion stage, allowing them to fine-tune the plan as needed.

With this phased approach, businesses can reduce the involved risks to a significant extent. It allows companies to allocate resources more efficiently and concentrate on delivering what matters most to their clients. They can ensure long-term growth by evaluating profitability.

Improvements in Effectiveness

Enhancing productivity helps businesses function more effectively, contributing to the bottom line. It paves the way for companies to put more money toward expansion by investing in novel technology or expanding their workforce.

Scenario Planning

It is a valuable tool to weigh the advantages and disadvantages of potential actions. It analyses the profit against growth, which is crucial for businesses analysing expansion into developing markets.

They can make better strategic choices in a changing industry environment if they run scenarios with different levels of market volatility and regulations so that they can see the costs of both short-term profits and long-term growth. Further, it also helps businesses to know more about the benefits associated with it for prospects.

Maintaining a Constant Watch

Keeping an eye on KPIs allows you to see patterns, which helps you to change your approach accordingly. For instance, when a business constantly analyses its financial and operational indicators, such as customer retention rates.

Monitoring these data in real-time allows them to identify patterns like decreased customer satisfaction. As a result, businesses can make timely adjustments to their plans, strengthening customer relationships. Moreover, they can also increase profits with this valuable data.

The Bottom Line: Sustaining Profitability While Fostering Growth

Balancing profitability and growth is becoming increasingly challenging, which calls for ongoing analysis and changes. Finding that sweet spot requires appropriately balancing a company's financial choices with its long-term goals.

The first step toward long-term success, whether for an established company or a young start-up, is realising that these criteria are not independent. By maintaining this balance, firms can set themselves up for sustained profit and growth!

Ajeet Agarwal

Managing Director, UK

OUTBOOKS

How Can AI Payroll Chatbot Possibly Revolutionise Payroll?

As we live in an increasingly digital and fast-paced world, businesses continually look for new methods to boost productivity and morale. Artificial intelligence (AI) technologies can have a revolutionary impact on the accounting and payroll sectors.

AI has extensive implications, from automating mundane tasks to lowering mistake rates and delivering rapid replies to employee concerns. Integrating AI into the financial sector will possibly increase efficiency, precision, and a more streamlined employee experience. AI-driven solutions provide timely assistance and insightful data using Natural Language Processing and Machine Learning.

Let’s explore how AI can possibly revolutionise the accounting and payroll industry—boosting the efficiency and morale of the employees.

The Digital Age of Finance: How Accounting and Payroll are Changing?

The accounting and payroll industry typically depends on paper-based record keeping, time-consuming human data input, and labour-intensive computations. Time-consuming and prone to human error, these traditional processes were an avenue for inefficiency and dissatisfaction among workers and financial experts.

Long delays in responding to employee questions about pay slips, tax withholdings, and other payroll-related concerns caused frustration and slowed productivity. However, the evolution of AI technology has ushered in a revolutionary period for the industry.

Machine Learning and NLP (Natural Language Processing) are two significant AI capabilities used to automate mundane operations, reduce human error, and respond quickly and accurately to employee requests.

This move towards automation is a break from the laborious tasks of the past since it not only boosts efficiency but also leads to a more user-friendly and smooth experience for employees and finance teams.

AI-Driven Assistance: The Future of Employee Engagement and Efficiency

Efficiency and employee engagement are experiencing a radical change. Rapid technological progress, especially AI and automation, can possibly accelerate employee engagement and efficiency to a significant extent.

Due to the advancements of AI in payroll, it will be possible to communicate with AI-powered chatbots to comprehend and answer intricate employee questions about their pay slips. Employees can utilise common phrases to pose their queries, making the whole experience more effortless with the help of Natural Language Processing capabilities.

Let’s look at a potential scenario to see how an AI-powered chatbot for payroll can impact employee engagement and efficiency. For instance, Sarah, an employee at a global firm, gets her pay slip and has some inquiries concerning the tax deductions she is entitled to.

She opens a chat window on her company’s portal and communicates with the chatbot rather than contacting HR and waiting for a response. Sarah’s tax deductions are broken down and explained in a few seconds. Further, she finds out that next month’s pay slip would be affected by forthcoming changes to tax legislation.

Meanwhile, the HR department is freed from answering questions like Sarah’s and can instead focus its resources on training and development tasks. The future of payroll management with the power of AI can look like this, with its increased productivity and better employee experience.

A Changing Paradigm: AI’s Ongoing Transformation in Accounting and Payroll

AI is changing everything; the payroll chatbot is only one illustration. We can expect further developments in accounting and payroll as technology progresses. Here are some of the glimpses:

In-Depth, Customised Financial Advice: Financial data collected from employees can be analysed by AI to provide personalised recommendations for budgeting, saving, tax planning, and more.

Predictive Analysis: Predictive models driven by AI can help businesses plan for future payroll expenses by seeing possible problems ahead of time.

Leveraging Blockchain Technology: When AI is combined with blockchain technology, there is less room for fraud or mistakes in payroll and accounting.

Managing Expenses: AI can automate expenditure monitoring and approval processes, making it easier for employees to submit their expenses and for businesses to compensate them.

Automation in Auditing: AI can speed up audits and reduce auditing expenses by analysing financial data and spotting outliers or irregularities.

Charting the Future: AI’s Lasting Impact

AI is expected to radically reshape the accounting and payroll industries as we gaze into the future of accounting and payroll. AI is leading the way toward a better, more efficient, and more employee-centric future in the accounting and payroll industries!

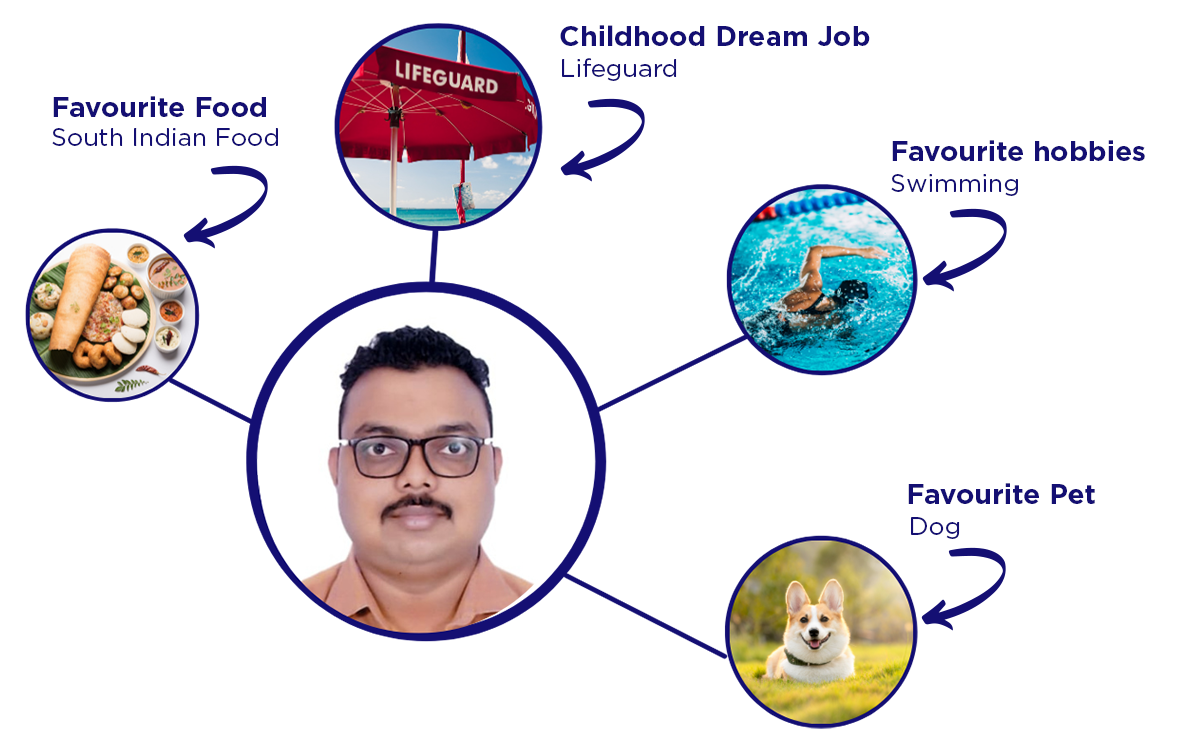

Uday Pawar,

Manager

What would you like to say to your leadership team?

Your unwavering trust, constant guidance, and the challenging opportunities you've given me have been instrumental in my growth. Thank you for being my pillar of support.

What would you say to someone considering a career with Outbooks?

If you're considering a career with Outbooks, be assured that it's the perfect platform to showcase your leadership abilities and learn new skills.

How has your career grown since you joined Outbooks?

My journey at Outbooks has allowed me to engage directly with clients, honing my leadership skills through effective team management.

Where do you see yourself in the next four years?

The team leader of 10+ with multiple client profiles. Four years from now, I envision myself leading a team of ten or more individuals, catering to a diverse clientele and continuing to push my boundaries. Each step of my journey at Outbooks has been about growth, learning, and embracing new challenges. I'm excited about the future and the possibilities it holds.

Training & Growth

The training department has worked towards excelling in making use of its resources to train 20 people on Nomi BK software.

We have also made sure to abide by the GDPR guidelines along with training the team on email etiquettes.

It was vital for the team to understand the turn around time at which we communicate with out clients and customers.

We were a part of the ACCA Virtual Fair 2023 to hire semi qualified and qualified professionals for our prestige organisation.

We have been trying to focus on expanding our team in Alwar along with making sure everyone in then organisation understands the quality that we deliver to our clients and customers.

Events & Updates

Tag Community

Annual Conference 2023 | Thursday, 5th October 2023

Outbooks will attend the TAG Community Annual Conference 2023 on Thursday, October 5, 2023, to discuss how outsourcing accounting services can help accounting firms, businesses, and individuals.

Outbooks will participate in the TAG Community Annual Conference 2023 to discuss how outsourcing accounting services can benefit accounting firms, businesses, and individuals. This event will provide valuable insights and networking opportunities for attendees.

Attending such conferences is an excellent way to stay updated on financial industry trends and connect with professionals in the field of accounting and finance.

Accountex Summit Manchester

Manchester Central | September 19 2023

The Accountex event on September 19, 2023, was held at the ExCeL London, England. Outbooks attended the event to discuss how outsourcing services can significantly help manage accounting compliance. The event was a significant showcase for the latest products and services for accountants and finance professionals. It featured over 300 exhibitors, 100+ speakers, and thousands of attendees.

Outbooks, a leading name in the outsourcing industry, marked its presence at the Accountex event held on September 19, 2023, at ExCeL London. The event served as a platform for Outbooks to showcase its expertise and demonstrate how outsourcing can be a game-changer for businesses seeking to save time, money, and additional stress.

The Outbooks team of experts were at the forefront, answering questions and engaging with attendees, sharing insights into the manifold benefits of outsourcing. From optimising financial processes to improving efficiency, Outbooks demonstrated how their top-notch expertise services can help businesses thrive in an increasingly competitive landscape.

The Accountex event begins an exciting journey for Outbooks and the businesses it serves. Stay tuned for more innovations and insights from this pioneering outsourcing company.