Choosing a price strategy for your company requires research, calculation, and careful consideration.

Accountants are significantly driving sustainability and making a massive difference in the ever-changing economy globally.

AI is transforming the accounting industry in response to the advent of cutting-edge tools that streamline and automate labour-intensive tasks.

The second quarter at Outbooks Outsourcing Pvt Ltd has been exciting with respect to the training and development of our new hires.

A Straightforward Pricing Resource: Discover All Ins and Outs of Pricing Strategies

Learn how to correctly price your goods, services, or events to increase sales and profit

Choosing a price strategy for your company requires research, calculation, and careful consideration. If you price your offer too cheap, you will lose money. If you overprice it, you may lose sales.

Price doesn't have to be a compromise or a guess. Numerous pricing models and techniques exist that can aid in your understanding of how to choose the appropriate rates for your target market and financial objectives.

The techniques and ideas in this article will help you feel at ease when setting prices for your items, regardless of your pricing expertise. Let's dive deeper to learn more about pricing strategies.

What Does Pricing Mean? Here are All the Top Nuts and Bolts of Pricing:

A pricing strategy is an approach to choosing the price you will charge. The ideal pricing is one that your clients will gladly pay while also maximising your earnings and professional success.

Your business's revenue goals, marketing objectives, target market, brand positioning, and product features are just a few of the elements that pricing strategies consider. Furthermore, outside variables impact them, including market and economic changes, customer demand, rival pricing, and general market trends.

What's the Gain from Nailing the Right Price?

The right price is all about a matter of the right balance. Your buyer will only buy your stuff if you price it expensive. If you price it too cheap, your margins will suffer, but people will buy it.

Additionally, it's not just about you and your client. When determining pricing, it's critical to compare them to the tactics employed by your rivals and the prices they are charging for similar goods.

Customers will use the prices in your market segment as a psychological reference point for a reasonable price; therefore, you should try to maintain pricing comparable to those of your rivals. Consider factors such as better product features, sustainable production, exceptional service, a no-frills retail experience, and other factors that will help your client understand why you charge for your products, brands, and services.

The Smart Way to Get the Right Price for Your Brand

- Must Use Price Calculator: You may use a variety of online pricing calculators to help you choose the appropriate cost for your good or service.

- Ask for Consumer Input: Find out how much your clients will spend on your goods or services. You may want to adjust your pricing approach considering this criticism.

- Employ a Pricing Strategy Manual: Several pricing strategy manuals may assist you in creating a pricing plan that is appropriate for your company.

Pricing Strategies Checklist: The Most Popular Pricing Models

- #Cost-Plus Pricing Strategy

A cost-plus pricing approach places all of the emphasis on the COGS, which is the cost of goods sold. It is sometimes called "markup pricing" since companies who employ this tactic "markup" the prices of their interests by how much they hope to make.Retailers who offer tangible goods frequently employ cost-plus pricing. Since their interests typically provide more outstanding value than the cost to produce them, service-based or SaaS businesses are not the ideal candidates for this strategy.

- #Premium pricing

A customer will perceive an item as having more value if it costs more. That's the logic behind premium pricing. A business using premium pricing intentionally charges more than its competitors, trading on a brand about quality and prestige.Brand value and product quality must be carefully built and maintained to make this strategy work. The upside is that markup and margin will be higher than typical for the product category.

- #Hourly Pricing Strategy

Hourly pricing, or rate-based pricing, is commonly used by consultants, freelancers, contractors, and other individuals or labourers who provide business services. Trading time for money is what hourly pricing entails. Some clients hesitate to honour this pricing strategy as it can reward labour instead of efficiency. But businesses can use this strategy to lure customers to try their products and services.

- #Free Subscription Pricing

Your primary product or service is free or ad supported. Users can pay extra for premium services or a better / ad-free experience. Dropbox illustrates a company adopting a freemium business strategy; it provides a limited amount of storage with a free account and charges consumers for more storage as needed.

- #Flat-rate Subscription

Users regularly pay a fixed fee, such as $9.99, for unlimited music streaming from their personal media collection. Spotify follows this business model for its core offering while providing discounted rates for students and family plans.

- #Sliding Scale Pricing

The cost varies depending on the customer's financial situation. This might be applied in fields like healthcare, where the customer's needs are considered financially and ethically. While a suggested or standard price is advertised and rates outside of that are negotiated on a case-by-case basis between the business and the consumer, this is comparable to pay-what-you-feel pricing.

- #Dynamic Pricing Approach

Dynamic pricing is not constant but varies depending on the circumstances. These variables may include, for instance, market segmentation, time, market fluctuations, or rival costs. Market-based pricing solutions in e-commerce frequently employ dynamic pricing.

Get the Most Bang for Your Buck: Tips & Tricks for Pricing

Here are some other suggestions for selecting the appropriate pricing:

- Utilise a pricing plan that is appropriate for your company. You can employ a wide range of alternative pricing schemes. Cost-plus, value-based, and competitive pricing are some prevalent pricing techniques. Select a pricing plan appropriate for your company and your target market.

- Use price discrimination if you dare. When you charge different clients with different rates for the same good or service, this is known as price discrimination. This can help you generate more money. You may, for instance, charge kids less for your good or service than you would charge adults.

- Use special offers and promotions to draw clients. Discounts and promotions may be a terrific method to draw in new clients and persuade current ones to make larger purchases from you.

- Monitor your sales statistics. Tracking your sales data will help determine how your price hurts your bottom line. This will assist you in modifying your price as necessary.

- It's critical to choose the appropriate pricing for your company. Following these suggestions, you may set prices to help you reach your company objectives.

Summing Up on Getting Your Pricing Right

Your brain may spin when you consider all the factors that go into the price, including rivals, manufacturing costs, consumer demand, industry requirements, profit margins, etc. Fortunately, you don't need to be an expert in areas simultaneously.

Have a seat, crunch some figures, and decide what's most important pricing factor can be you're your brand. Crucial for your company. You may choose the best pricing plan by starting with what you require.

But most of all, remember that pricing is an iterative process. It's unlikely that you'll determine the appropriate pricing on the first try; it could require a few trials (and much investigation), and that's OK.

Amit Agarwal

Managing Director, UK

OUTBOOKS

Accountants Can Change the World by Driving Sustainability. Would You?

Accountants are significantly driving sustainability and making a massive difference in the ever-changing economy globally. Professional accountants can do more than crunch numbers; they can also foster environmentally friendly policies and procedures for creating a more sustainable future.

Most people trust their accountants to keep their finances well organised and comply with all applicable regulations. But that's not all they do. Accountants are pivotal in promoting sustainability initiatives at work and in their communities.

Here comes the revolutionary potential of accountants!

Auditing and Reporting on Environmental Conditions: Businesses seek the help of accountants to reduce their adverse effects on their surroundings. They aid in lowering their carbon emissions, waste, and usage of resources by performing environmental assessments to discover problem areas and devise solutions. Likewise, accountants are vital in publicly presenting these environmentally friendly initiatives, giving clients accurate data on the company's environmental accomplishments.

Factoring in Environmental Expenses While Making Choices: Decisions in the financial sector have typically been driven mainly by an impulse to maximise short-term gains. This thinking may be against accountants' review, considering environmental expenses and dangers as part of their work. Accountants show that green initiatives are financially beneficial by calculating the long-term effects of conservation efforts on a company's bottom line.

Environmentally Friendly Supply Chain Management: Accountants utilise various tools to examine a company's supply chain to pinpoint places for enhancing sustainability. They work with purchasing groups to assess vendors' environmental impact and moral standing. Accountants help mitigate environmental damage from supply chain operations by advocating for sustainable purchasing and ethical buying.

Top Tips for Accountants on Promoting Environmental Responsibility at Your Workplace:

- Keep up with recent sustainability initiatives and rules to fully grasp how they might affect your business.

- Team up with coworkers from other divisions to promote a sustainable culture and boost cross-departmental cooperation on green projects.

- To properly evaluate and analyse environmental outcomes, businesses should adopt "sustainable accounting methods" by incorporating environmental metrics into financial reporting methods.

- Facilitate positive change by using your knowledge of finance to educate decision-makers and encourage environmentally friendly actions within and outside your firm.

As an accountant, you are crucial to advancing sustainability and making positive global change. Using environmentally friendly accounting methods, campaigning for change, and integrating sustainable practices into financial choices are all ways to bring a difference.

Make the future more environmentally friendly with sustainable accounting methods!

Ajeet Agarwal

Managing Director, UK

OUTBOOKS

Artificial Intelligence (AI) in Accounting Industry

AI is transforming the accounting industry in response to the advent of cutting-edge tools that streamline and automate labour-intensive tasks. The ability of artificial intelligence to handle massive quantities of data and executes complicated tasks in more simplified ways is revolutionising the accounting industry, leading to more precision, greater efficiency, and better decision-making than ever before.

The term artificial intelligence describes the use of computer programming to give machines human-like cognitive abilities. There have been substantial developments in the accounting field due to the widespread use of artificial intelligence technologies that automate and optimise numerous activities.

Simplifying Bookkeeping and Data Entry

AI is drastically altering the bookkeeping and data entry processes through its rapid development. Invoice processing, data entry, and reconciliation can now be automated with machine learning algorithms, saving accountants’ time and minimising the likelihood of human mistakes. Automated classification, innovative document extraction, and intelligent audit trails are just a few of the cutting-edge capabilities that AI-powered bookkeeping applications offer.

Consider, for example, a business that regularly gets several invoices from various suppliers. AI-powered software can read these invoices, and each vendor’s name is extracted and entered into the appropriate field in the accounting system. Further, AI-powered software can precisely read and input the invoice’s date, total, and line items.

In addition, the AI-powered software also can intelligently categorise invoices according to a set of criteria based on your specifications. It can classify bills as operating or capital expenses depending on their contents. This system allows accountants to review each invoice no longer individually and manually assign categories.

Enhanced Financial Forecasting Using Predictive Analysis

Precisely anticipating financial consequences is essential for making well-informed choices. By evaluating past financial information, market patterns, and other pertinent factors, accountants can generate more precise predictions with the help of AI-powered predictive analytics tools. Using machine learning algorithms, accountants can forecast the flow of funds, revenue, and costs, allowing organisations to make better strategic choices.

For instance, the software can determine that seasonality, advertising efforts, and regional economic circumstances significantly affect the company’s sales. It finds connections and patterns in the data that human accountants would miss.

AI tools can use this data to develop a forecasting model that accounts for all these aspects and how they affect revenue. Monthly or yearly sales revenue estimates are only two examples of what the model can predict for the future.

Compliance and Auditing using Artificial Intelligence

Accounting relies heavily on auditing, and AI is changing the auditing landscape. AI systems are more effective than human auditors in sorting through mountains of financial information in search of outliers and red flags that indicate compliance difficulties. Financial inaccuracies and non-compliance can be mitigated using AI-powered audit solutions that improve risk assessment procedures and assure compliance with r egulatory requirements.

The AI system can review business expenditures to identify any out-of-the- ordinary or questionable expenses such as excessive spending, dealing with unapproved suppliers, or repeated reimbursement for the same person can be spotted.

In addition, the AI system can keep learning and adjusting as new data and trends become available. Algorithms and rules can be updated to reflect new regulations and industry standards. It ensures that auditing procedures are always relevant and can address any possible compliance concerns.

Preparing Tax Returns

The process of preparing tax returns is often tedious and complicated. Tax preparation is one area where AI makes life easier and more efficient. Data gathering, cost categorisation, and conformity with tax laws can now be simplified using AI-powered applications. In addition, tax planning tactics can be better optimised with the help of advice provided by machine learning algorithms that have learned from past tax records.

Imagine a sole proprietor who has to complete their tax return every year. In the past, taxpayers had to compile their financial records, manually classify their spending, and hand-fill out their tax forms. It may be a tedious procedure with room for mistakes, which might result in noncompliance or missing deductions.

The small company owner can save time and avoid mistakes by using tax preparation software driven by AI. Integrating with an organisation’s accounting software or scanning and extracting data from paper documents like invoices and receipts are two ways AI software might automate data collection.

Income, expenditures, and deductions are only some of the financial data the software may automatically extract, cutting down the need for human input. Based on specified principles and machine learning algorithms, it can classify expenditures like office supplies, travel expenses, and advertising costs into the correct tax categories.

Chatbots and AI Assistants

The accounting sector is making greater use of chatbots and other AI-powered virtual assistants to enhance client service and expedite communication. These intelligent systems aid with basic bookkeeping, answer frequently asked queries, and offer real-time assistance. Using chatbots and virtual assistants, accounting organisations can significantly improve customer happiness, turnaround times, and productivity.

Fraud Detection

Most businesses face a severe threat from accounting fraud. The good news is that AI is helping immensely in combating fraud. Algorithms trained by machine learning can sort across large quantities of financial information in search of trends and anomalies that indicate fraud. Businesses can improve their capability to identify fraud and reduce financial risks by using fraud detection systems driven by artificial intelligence.

The Future of AI in Accounting

More and more AI tools are finding their way into accounting, leading to exciting new developments. Accounting professionals will have more time for higher-value tasks as AI continues to automate mundane chores. Here are some future applications of AI in accounting:

Robotic Process Automation, or RPA

RPA is an emerging technology that uses software bots to significantly improve automation potentials and pay the way for the easy integration of many accounting systems and applications.

The benefits of RPA in accounting are as follows:

- RPA bots usually gather information from documents like invoices, receipts, bank statements, etc., reducing human intervention and eliminating the possibility of human mistakes.

- RPA bots automatically create reports based on predefined criteria which are both consistent and timely.

- RPA automates the reconciliation process of matching and validating financial transactions across multiple accounts or systems, expedites the process, increases accuracy, and lessens mistakes.

- RPA helps with compliance by keeping meticulous records of all financial dealings, data updates, and user interactions with the system.

- RPA bots complete activities in parallel, making it easier for organisations to adapt to growth and season swings as transaction volume increases.

Natural Language Processing, or NLP

NLP is a subset of AI concerned with how machines and humans communicate. Information from contracts, invoices, and financial reports, all unstructured data sources, can be extracted and comprehended using NLP technology in the accounting field.

The benefits of NLP in accounting are as follows:

- NLP extracts financial information from unstructured text documents with plain text instead of more complex coding, boosting productivity without sacrificing accuracy.

- NLP more efficiently categorises documents based on their contents, invoices, purchase orders, contracts, etc.

- NLP helps with sentiment analysis to examine financial data or customer feedback in an accounting setting.

- NLP helps with regulatory compliance by spotting references to specific regulatory frameworks, evaluating compliance with contract terms, and highlighting any regulatory breaches.

Blockchain Technology in Auditing

When used in auditing, blockchain technology and AI promise to bring transparency, immutability, and streamlined efficiency.

The benefits of blockchain technology in accounting are as follows:

- Blockchain technology allows the emergence of a distributed, immutable ledger for recording monetary transactions. Time stamps, cryptographic signatures, and distributed storage ensure that all transactions are safe and secure.

- AI algorithms analyse the blockchain to ensure all transactions are valid and complete, which uncovers anomalies and errors by comparing transactions with industry standards.

- Blockchain technology allows for the instantaneous recording of monetary transactions, giving stakeholders more timely and relevant insights without over-relying on retrospective sampling.

- A more efficient audit is possible because of the streamlined audit trail by Blockchain, which provides a complete picture of the company’s financial activity.

- Smart contracts built on the blockchain enforce contractual terms and conditions for monetary dealings. AI systems can review these intelligent contracts to confirm compliance with legal mandates or company regulations.

Sum Up

Accountants must acquire new skills and learn to work with new technology as AI proliferates in accounting. To maximise the potential of AI, accountants should have an in-depth knowledge of the advanced technology and its many uses. It will be more important for accountants and AI systems to work together, with accountants offering supervision and knowledge while AI automates routine activities and analyses data.

Monika Sharma,

Assistant Manager

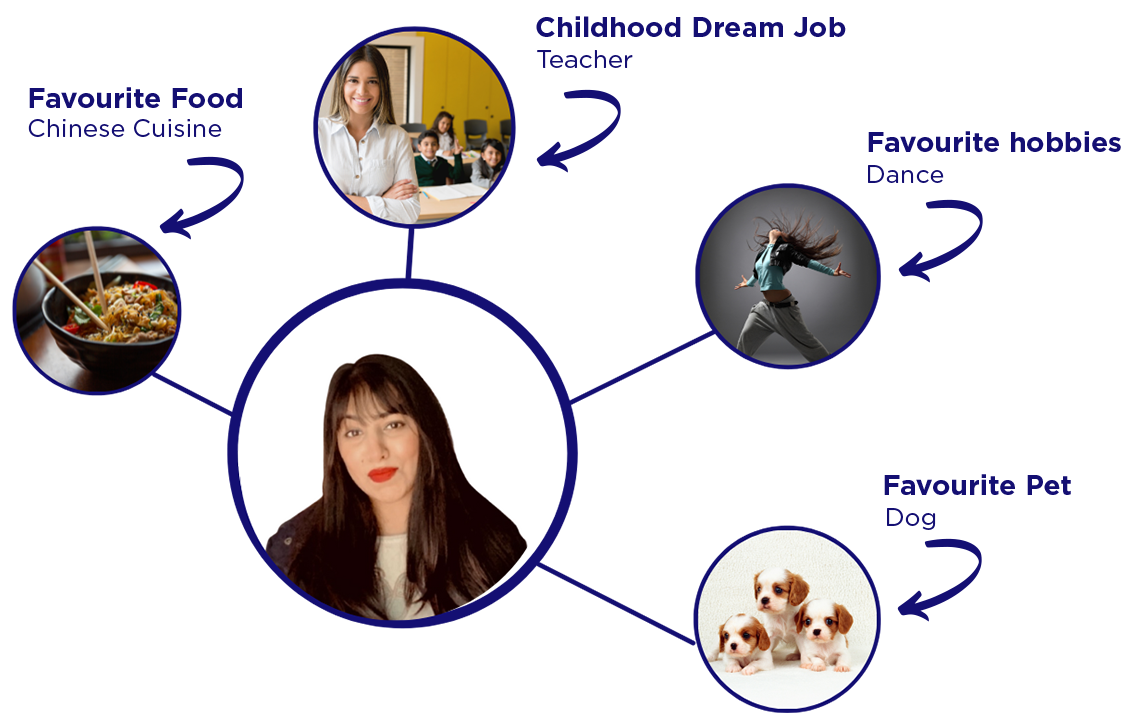

What would you like to say to your leadership team?

We should always appreciate our team members in order to motivate them to work with complete dedication.

How has your career grown since you joined Outbooks?

It has grown tremendously, as previously I had experience in NZ accounting, but now I know about UK accounting too, which is an addition to my knowledge.

What would you say to someone considering a career with Outbooks?

The person (he or she) should join this company to grow faster.

Where do you see yourself in the next four years?

I continue to grow in my career and take on more responsibilities within the company.

Training & Growth

The second quarter at Outbooks Outsourcing Pvt Ltd has been exciting with respect to the training and development of our new hires.

We hired almost 20 freshers to train them in the field of accounts finalization and bookkeeping.

We also added several other training sessions on platforms like Xero and QBO for our internal teams.

Learning has been a vital part of this organization day in and day out and the Training department has been relentlessly working to achieve this.

Nevertheless, our extensive bookkeeping and year-end training helps the organization have new resources to utilize optimally.

Events & Updates

Accountex, ExCel, London

Outbooks Exhibited at Accountex ExCel, London

Outbooks, a leading accounting and bookkeeping outsourcing service provider, recently attended the Accountex event hosted at ExCel, London, on 10-11 May 2023. Outbooks' team of experts were on hand to answer questions on how outsourcing can help businesses save time, money, and stress with top-notch expertise.

The Accountex event was a success for Outbooks, and the company generated significant interest in its services. We showcased our services to many potential customers and generated positive buzz about the brand. Outbooks is well-positioned to continue to grow its business in the coming years.

Digital Accountancy Show

Outbooks exhibited at Digital Accountancy Show, London, on 15th June 2023 where game-changers, famous accountants, and industry leaders discussed the latest trends and advancements in the accounting industry.

Accountex, Summit, Manchester

Outbooks is all set and excited to be part of the incredible upcoming event Accountex, Summit, Manchester on 19th September, 2023