5 Compelling Reasons to Hire an Accountant for Your Self-Assessment Tax

Thinking about doing your self-assessment tax can make small business owners uneasy. If you’ve ever enjoyed dealing with HMRC’s ‘Tax helpline,’ you know it’s no walk in the park.

The dream of running your own business can become a nightmare when you scramble for lost receipts and burn the midnight oil over expenses.

At some point, every self-employed person wonders, “Should I get an accountant for my taxes?” Well, biased or not, the response would be a big YES!

Having an accountant for your taxes makes the whole process faster, simpler, and even cheaper. It’s like having a guide on this rollercoaster of self-employment.

Who is required to submit a self-assessment tax return?

Employees typically have their tax deducted at source via Pay As You Earn (PAYE) and do not need to file a self-assessment tax return. However, most self-employed people without tax deducted at source must file a self-assessment tax return for HMRC to tax their earnings accurately.

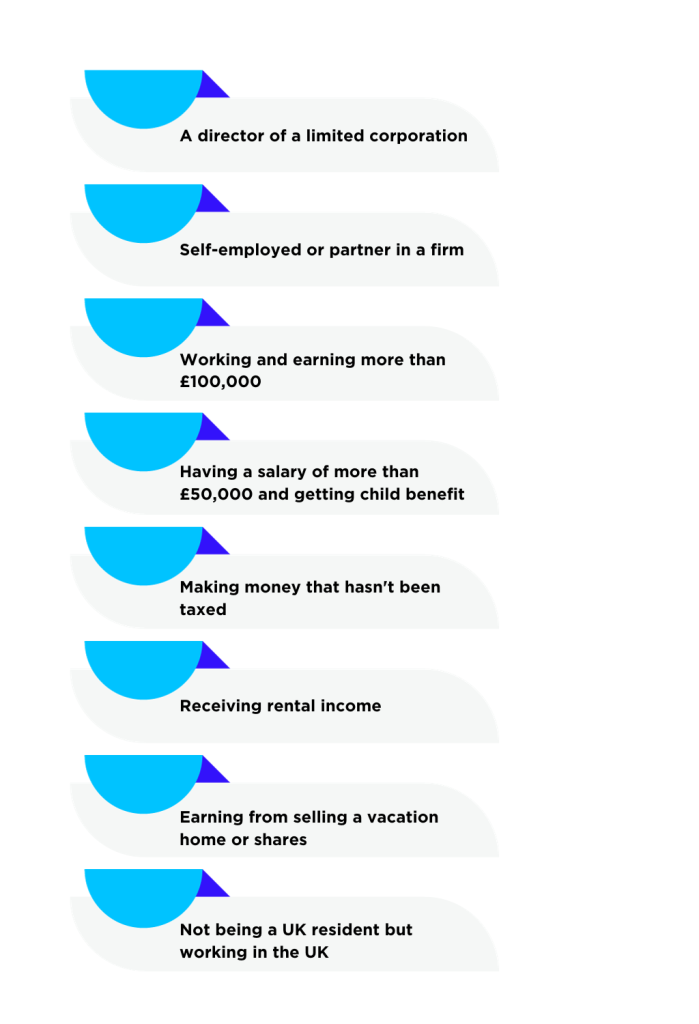

If you fall into one of the following groups, you must file an HM Revenue & Customs tax return:

- A director of a limited corporation

- Self-employed or partner in a firm

- Working and earning more than £100,000

- Having a salary of more than £50,000 and getting child benefit

- Making money that hasn’t been taxed

- Receiving rental income

- Earning from selling a vacation home or shares

- Not being a UK resident but working in the UK

How Accountants Can Ease Your Burden

This is how accountants can ease your burden:

Never Miss a Deadline

An accountant is your timekeeper, meticulously following HMRC’s essential registration and filing deadlines. They don’t simply remind you; they take over and file everything for you, ensuring that all crucial deadlines are completed on time.

If you file your self-assessment tax return with errors or inconsistencies, or if you miss a submission deadline (31st January for online returns, 31st October for paper forms), HMRC will most likely contact you, which is something no one likes.

They will also be current on all tax law developments and thoroughly aware of all tax regulations, allowances, and dangers.

Get Assistance from Tax Law Experts

General tax law can be hard enough, but with all the changes, you must be up to date if you go it alone. Professionally qualified accountants must attend professional development and update courses at least once a year to maintain their certification and practice as qualified accountants.

This lets them provide you with the best advice to reduce your tax liability immediately. However, if you have previously done your tax return wrongly and hire an accountant who knows the laws and corrects you moving ahead, it may cost you more than simply their fee. However, you may not have been claiming for items you could have.

Highlight Potential Future Cost-cutting Measures

An accountant is more than a tax expert; they are a year-round consultant. They inform you of cost-cutting opportunities, provide business growth advice, and update you on changing tax legislation.

Their proactive counsel can be invaluable in moulding your company’s financial destiny and transforming tax planning into a strategic asset for growth and stability.

Help You Reduce Stress

Completing your self-assessment tax return requires substantial time and work, and it can be highly stressful, especially if the deadline is approaching! If you do it yourself, you’ll need to gather the necessary information and documents, comprehend deductible expenses, tax codes, and allowances, and finish the return before submitting it.

Your self-assessment tax return will be processed quickly and expertly if you entrust it to an accountant. An accountant will have done numerous returns and be well-versed in HMRC’s processes, providing a painless submission process.

Get On-time and Accurate Filing

A recurring issue is that if you send your data to the accountant when required, you’ll have enough time to thoroughly review it and file it to save up for it. It is pointless to hand up your data in December/January and expect everything to be correct and filled to avoid late penalties.

Suppose you follow the checklist supplied by the accountant. In that case, everything will likely be ready simultaneously, and you will not have to waste energy, time, and money to restart the process.

Tax Compliance-Sorted… This is How Outbooks can assist you…

Outbooks assists clients with HMRC tax computation, return filing, and presentation to tax authorities. The quantity of personal tax returns filed on behalf of our UK accounting clients from our end is outstanding.

With a thorough understanding of the system and its rules, we are well-equipped to provide expert advice and assistance that has helped our clients adhere to HMRC Self-Assessment Tax Return criteria over the years.

Furthermore, with over twenty years of experience in tax-related activities, our skilled tax consultants can provide a master Self-Assessment Tax Returns service to ensure your tax return is accurate, submitted on time, and arranged to minimise tax burden.